Portfolio

Die Immobilien von Swiss Prime Site verfügen ausnahmslos über eine hohe Liegenschafts- und Standortqualität. Darüber hinaus weisen sie insgesamt eine gute Nachhaltigkeitsbilanz aus. Insgesamt umfasst das Portfolio rund 140 Liegenschaften. Die Gesamtnutzungsfläche beträgt ca. 1.6 Mio. m².

Mit der Akquisition von kommerziellen Liegenschaften, Arealen oder Grundstücken wird der Wertschöpfungsprozess initiiert. Unseren unternehmerischen Fokus bilden in erster Linie das Portfolio und das Asset Management. Darüber hinaus sind Entwicklungen und Realisierungen von Immobilienprojekten sowie Umnutzungen oder Modernisierungen ganzer Areale von grosser Wichtigkeit für die Wertschöpfung. Das erstklassige Immobilienportfolio wird kontinuierlich strategisch und im Rahmen des CO2-Absenkpfades optimiert.

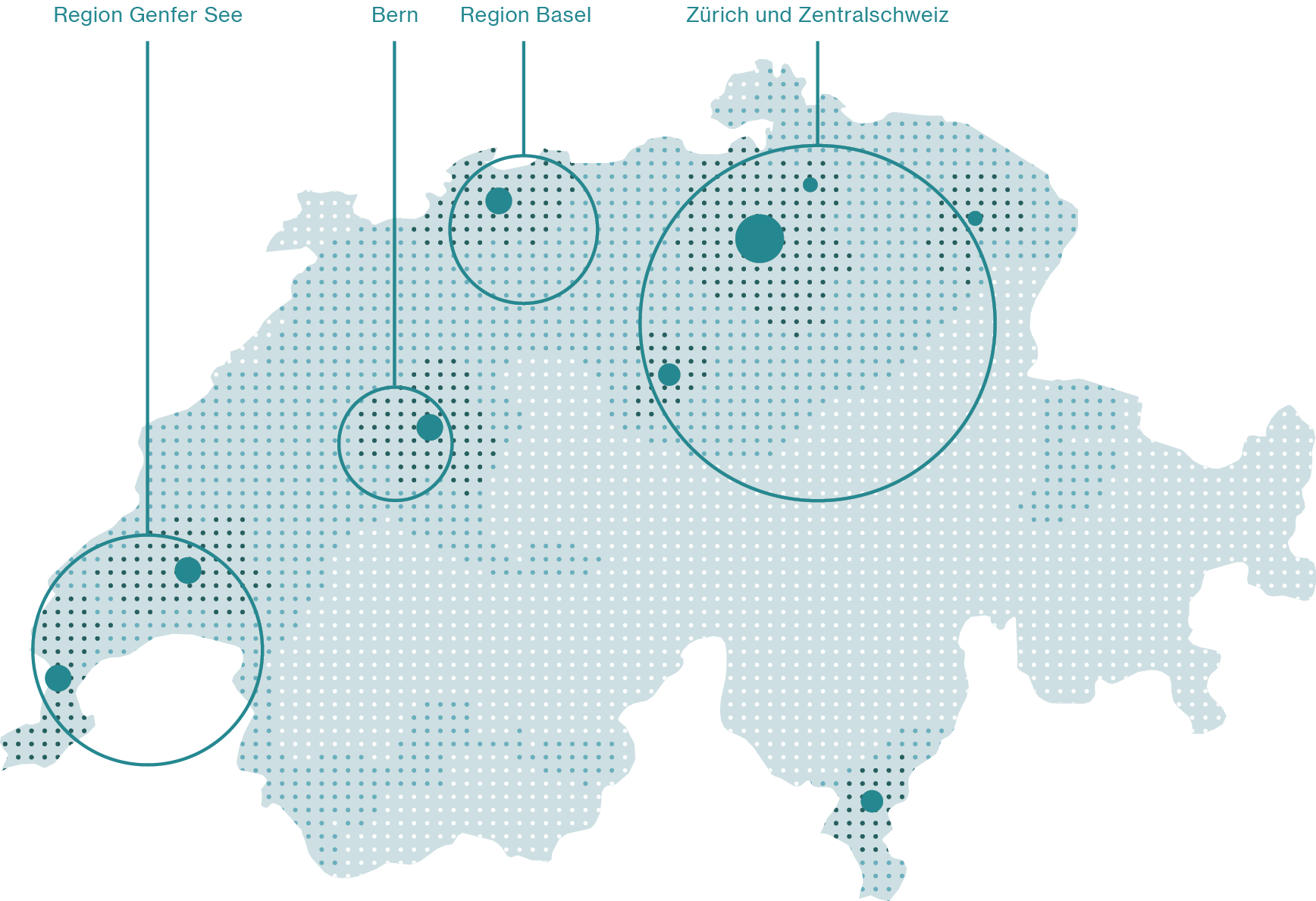

Geografische Verteilung

Flächennutzungen

Im Fokus stehen zur Hauptsache die Bedürfnisse von Gewerbe- und Dienstleistungsbetrieben. Die beiden aktuell bedeutendsten Nutzungsarten sind vor allem Büro aber auch Verkauf. Stark wachsend ist die Nutzungsart Logistik und Infrastruktur.

Portfolio nach Nutzungen

Portfolio nach Nutzungsart1

Basis: Nettomietertrag per 31.12.2024

Loading...

1 Segment Immobilien

Klimaneutralität bis 2040

Ein detaillierter CO2-Absenkpfad wurde 2019 für das gesamte Immobilienportfolio entwickelt. Das Ziel ist die Klimaneutraliät bis 2040. In diesem Kontext weisen wir transparent aus, mit welchen Ressourcen wir arbeiten und wie diese passend eingesetzt werden. Dazu werden ambitionierte Zwischenziele verfolgt. So etwa die Zertifizierung sämtlicher Flächen und das Erzielen von herausragenden Scores in Assessments wie GRESB sowie sämtlichen ESG-Ratings.

Ihr Kontakt