About us

For over 25 years, Swiss Prime Site has stood for the creation and design of living spaces where people live, work and go out. Today, we are the leading real estate company in Switzerland, with the experience and size to facilitate a more sustainable and value-oriented use of buildings in the future.

Our extensive experience in property development and letting has resulted in enduring relationships with our tenants and partners. It forms the foundation for our detailed understanding of market needs, both now and in the future, and gives us the ability to anticipate and shape trends. We have over CHF 26 billion in property assets and this scale gives us a decisive advantage in extensively leveraging our experience and expertise. Our size means we can drive innovation in construction and building operations, develop large sites, offer a wide range of products and solutions, and set standards for sustainable buildings. Through our actions, we create long-term,sustainable value for our customers and society as a whole.

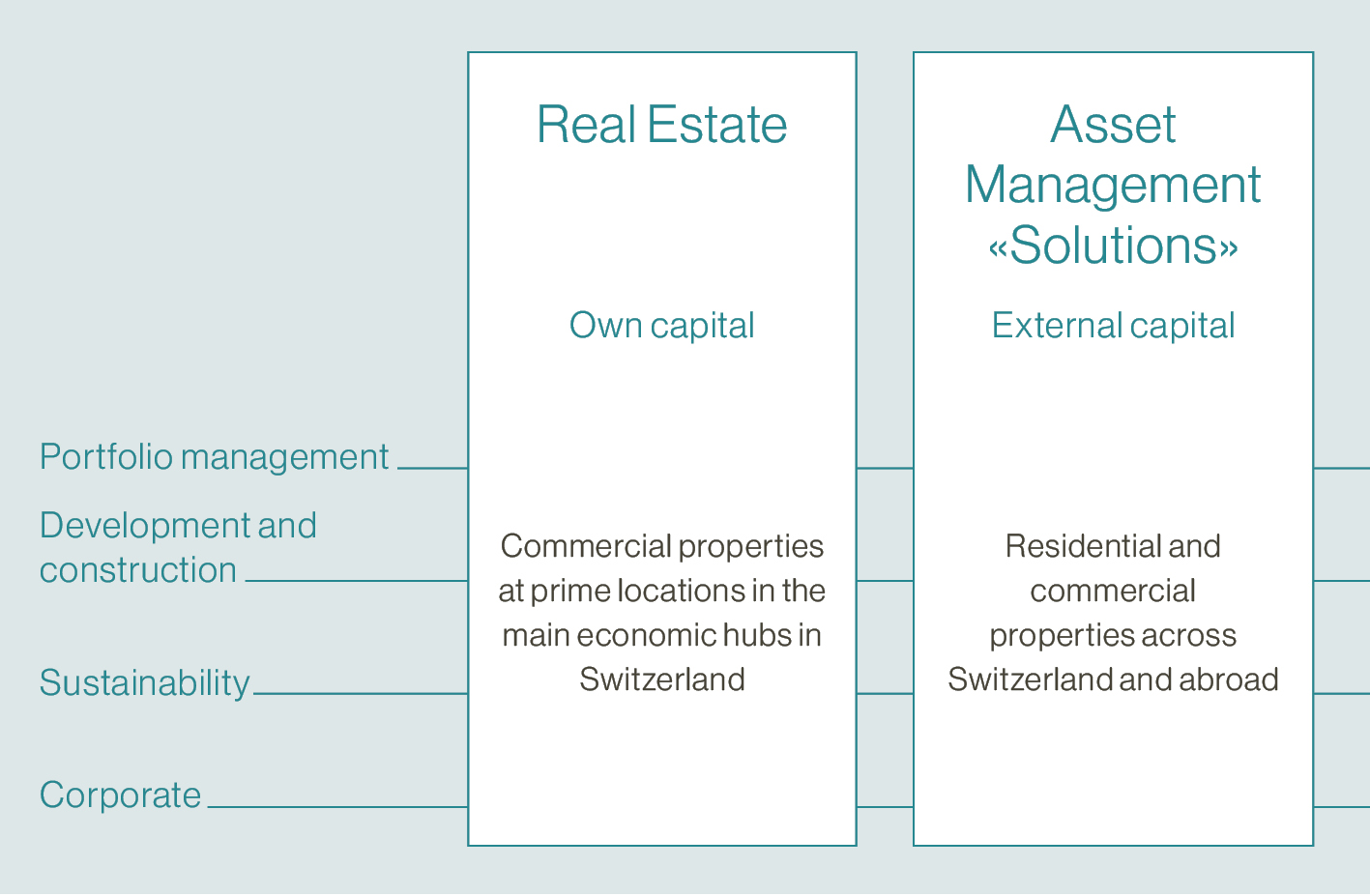

One platform. Two pillars.

Our aim is to use our expertise as widely as possible – which is why we have created a platform that allows us to invest our own capital as well as external capital in property assets. Our strategy is based on two strong pillars: the Real Estate business area, in which we invest our own funds in commercial real estate, and the Asset Management business area, in which we invest external funds from investors, particularly in residential real estate. Here, our size offers us advantages over other market players and we serve a particularly broad spectrum of investors and customers. Our specialist expertise in active portfolio management, in development and in sustainability can be applied across our entire portfolio to realise synergies. We also benefit from economies of scale in centralised functions such as finance and IT.

Sustainability

Sustainability has been part of our business and value creation model and an integral component of our strategy for some time. It enables us to increase Swiss Prime Site’s resilience, and we are convinced that we are creating long-term added value for our stakeholders and for society as a whole. A detailed materiality analysis, reviewed on an ongoing basis, forms the basis and focus of our commitment in this area. We plan, implement and measure the impact of the key topics for us and our environment along the six fields of action derived from the analysis. To put it in a global context, we establish the connection to the United Nations Sustainable Development Goals (SDGs). We have developed a detailed CO2 reduction pathway based on the Swiss government’s Energy Strategy 2050 and the international climate goals. Our primary objective is make the operational management of our property portfolio free of emissions by 2040. Sustainability is likewise of great importance in our corporate financing. Currently, around half of our external financing is linked to measurable sustainability goals.

Financing strategy

Real estate is a capital-intensive business, so a solid financing base is essential for our operational activities. Our focus here is on achieving a high degree of flexibility, minimising risks, optimising costs, while also focusing on sustainability. Our approach is:

- To keep debt ratios low

- To have a high share of unencumbered assets

- To maintain a high liquidity reserve

- To have a wide range of financing sources

- To fully link long-term financing to the sustainable use of funds

We aim to be an attractive investment for our shareholders, and payment of ongoing dividends is one way we achieve this. Our dividend policy provides for the annual payment of dividends equal to 80–90% of our operating cash flows (as measured using the FFO I metric), with the aim of maintaining or growing its absolute level.