Corporate responsibility

We can only achieve long-term economic success if we take responsibility. This includes responsibility for the environmental and social impact of our business activities and value creation. We view value creation as a holistic undertaking. It combines financial objectives with non-financial aspects.

Topics where we can make the greatest impact:

- Systematic achievement of the 2040 climate target under the CO₂ reduction pathway in operations.

- Implementation of the Circular Economy Charter by cutting indirect greenhouse gas emissions and reducing non-renewable primary raw materials to 50% of the total mass in all new build projects.

- Assumption of responsibility while taking into account the needs of all our stakeholders, by generating added value consistent with current and future social framework conditions.

As a leading Swiss real estate company, we lead by example and are aware of our responsibilities towards our employees, the environment and society with regard to sustainability. Our vision is to create sustainable environments – using innovation and passion to add value. Sustainability is part of our business and value creation model and has been an integral and unifying component of our strategy for some time. This includes compliance with legal requirements and regulatory standards, adhering to self-defined principles and directives and also, increasingly, directly influencing our partners’ value chains. This increases our resilience, and we feel confident that we are creating long-term added value for our stakeholders and for society, as well as seizing the opportunities that arise from our company’s sustainable approach. At the same time, we see our sustainable orientation as a shared guiding principle for our collaboration internally and externally. Our employees and our corporate culture provide the foundation for our sustainable behaviour and sustainable outlook. And, finally, this allows us to avoid potential adverse effects for the environment, for society, and for our own business activities. The responsibility of the real estate sector for the environment and for society is reflected in our approach to sustainability, the material topics and our objectives. They are closely tied to our business model and cover responsibility throughout the value-creation chain – from development and construction through to use and operations.

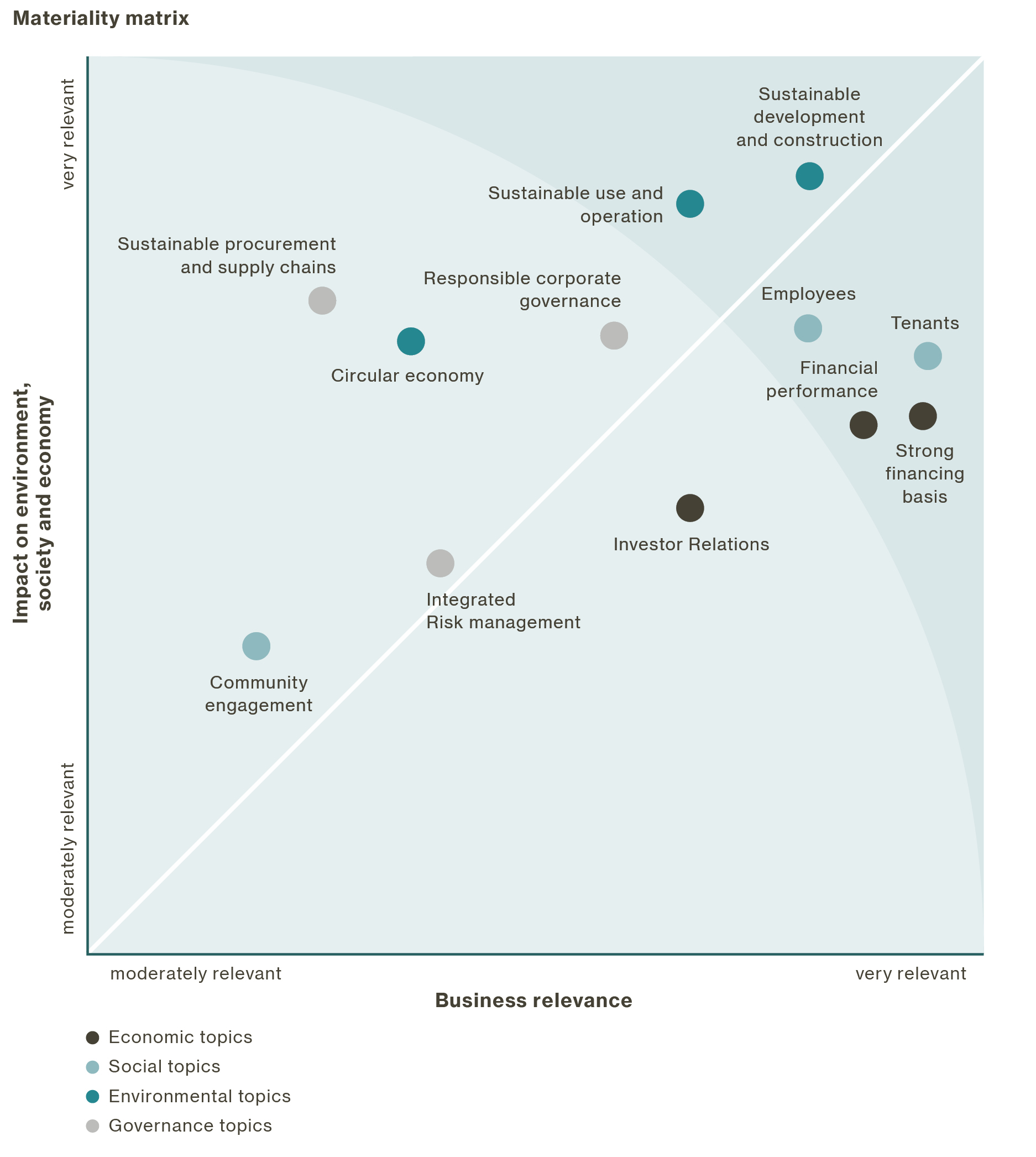

Materiality matrix

The materiality analysis identifies significant topics from environmental (E), social (S) and governance (G) areas, as well as economic efficiency.

We regularly review which topics are most important for the long-term sustainable development of the Company. The materiality analysis updated last year already reflects the business model based on our two pillars – «Real Estate» and «Asset Management». The materiality analysis is based on the one hand on the key elements of the corporate strategy and long-term planning, and on the other on extensive stakeholder surveys.

Materiality analysis

In a materiality analysis, we identified twelve relevant topics from the categories of the economy, society, the environment and governance. The analysis applied the principle of double materiality. In a survey, the relevant stakeholder groups assessed the impact of our business activities on the environment, society and/or the economy. Our Executive Board assessed the relevance of the respective topics in relation to our business success. The resulting materiality matrix was validated by management and the Board of Directors, and will be reviewed for currency in 2025.

Material topics

The materiality matrix summarises all the topics and results of the double materiality analysis in one graphic.

The matrix shows both material topics that predominantly impact the environment, society and the economy (topics above the diagonal) and those topics that predominantly impact business success (topics below the diagonal). Environmental and governance issues play a more central role in the impact of our business activities, while financial issues, employees, tenants and customers take precedence in terms of their relevance to our business success. The material topics provide the basis for focussing our sustainability strategy.