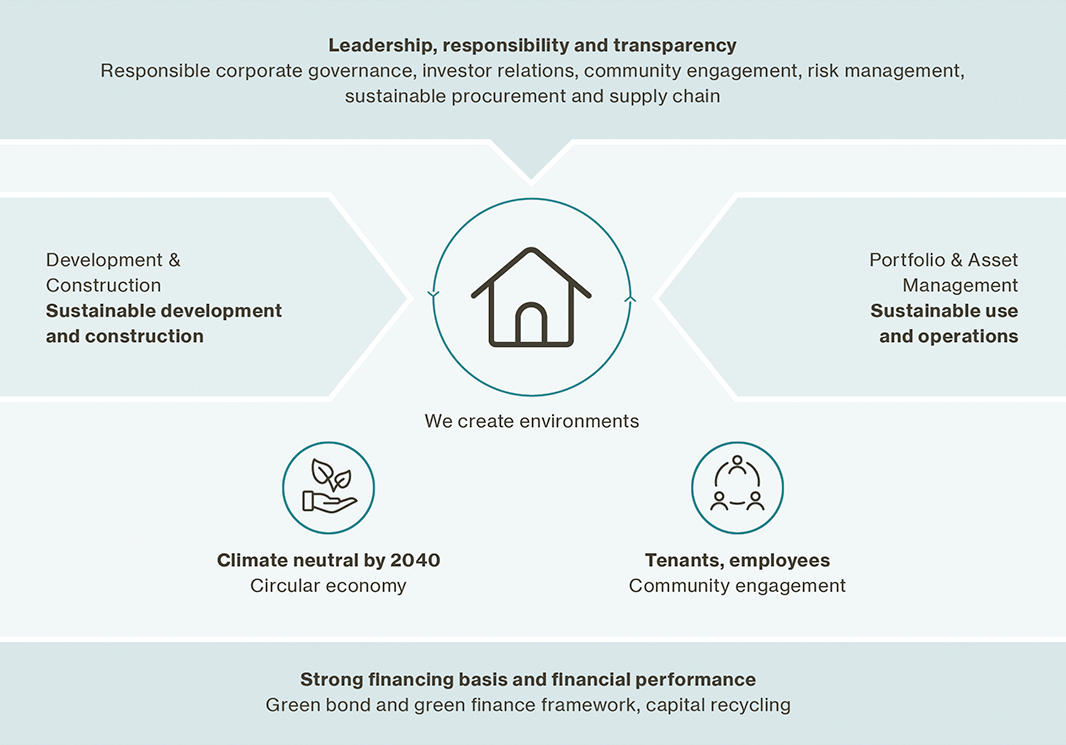

Sustainability strategy

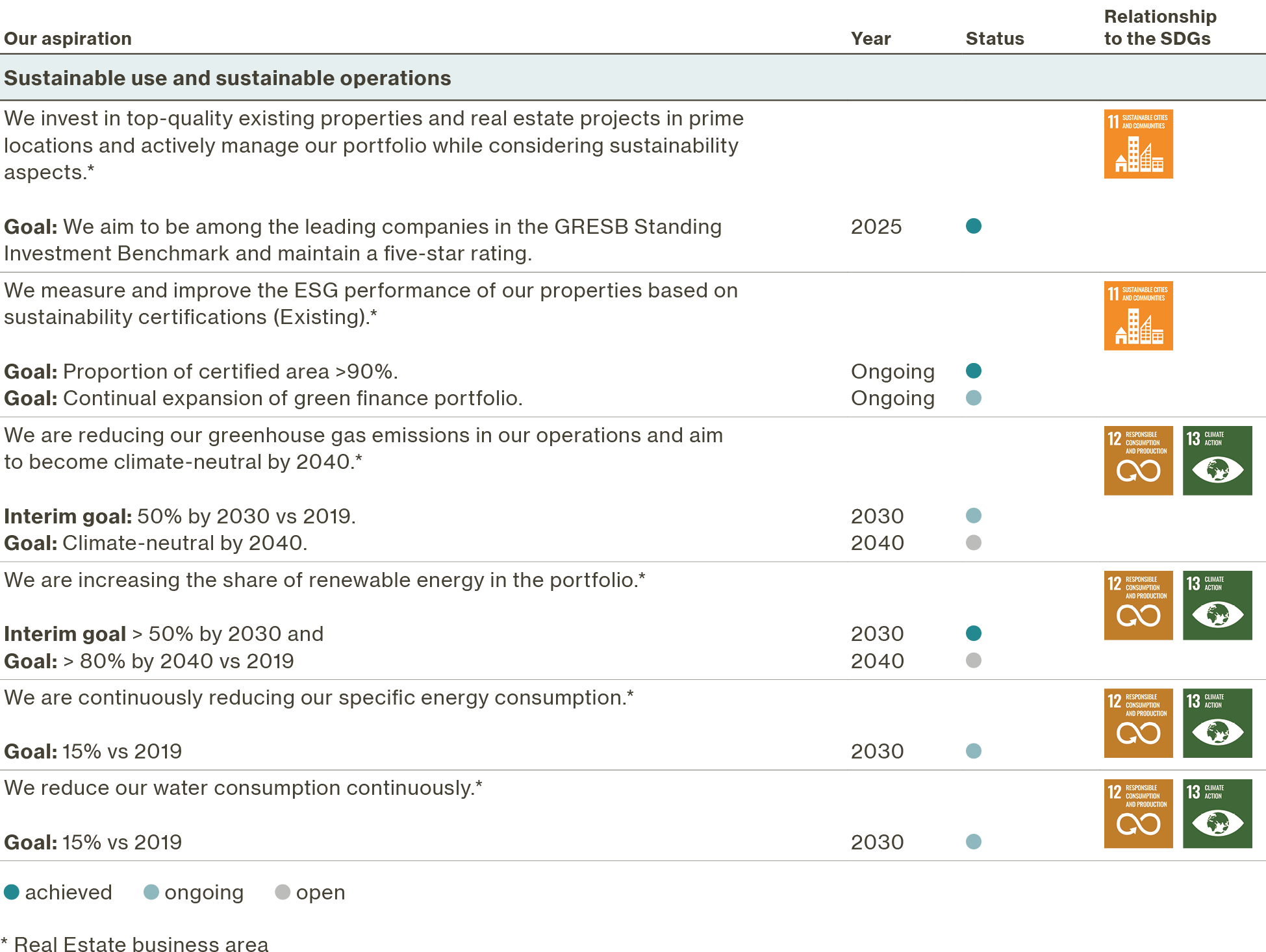

We aim to lead by example, and we see sustainability as a key aspect of our actions. By 2040, our property portfolio will be climate-neutral in its operations. We set the highest standards for certification and benchmarks in our development and property portfolios, and are actively committed to the ambitious goals of the circular economy.

Our strategy is aligned with the material topics and integrated into our business, as shown in the annual report.

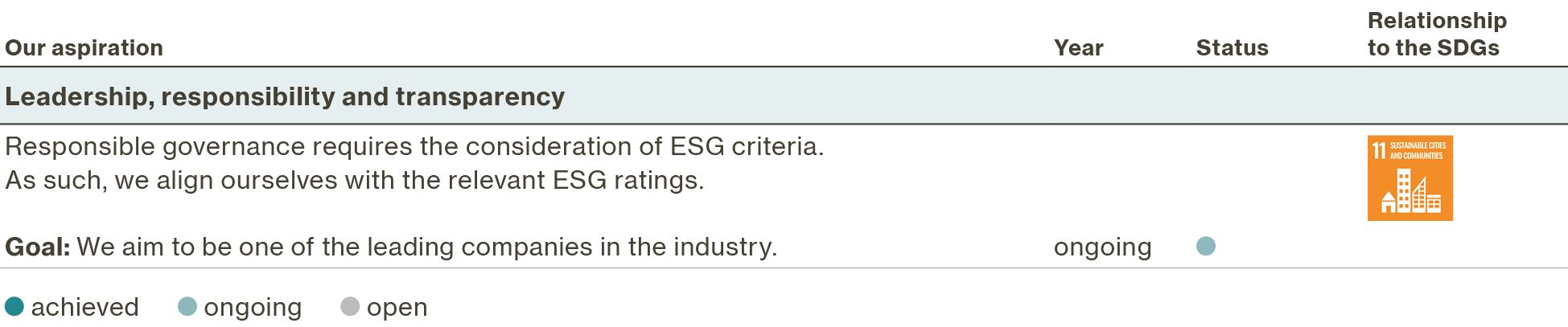

Leadership, responsibility and transparency

For us, responsible management and transparent communication are key. Our aspiration is to be one of the leading companies in the sector. We demonstrate this in our reporting in line with the GRI Standards and the Task Force on Climate-related Financial Disclosures (TCFD) and industryspecific standards such as those of the European Public Real Estate Association (EPRA) as well as through the corresponding ESG ratings and benchmarks. With the signing of the UN Principles for Responsible Investment (UN PRI) and Swiss Prime Site Solutions’ membership of the Asset Management Association Switzerland, we have also incorporated these principles into Asset Management.

Strong financing base through Green Finance

Our investors appreciate the opportunity to invest their capital in real estate that is demonstrably sustainable. Currently, around 63% of our external financing is linked to measurable sustainability goals. In the 2022 reporting year, we implemented a comprehensive «Green Finance Framework», thus laying the foundation for linking all financing to sustainability in the medium term.

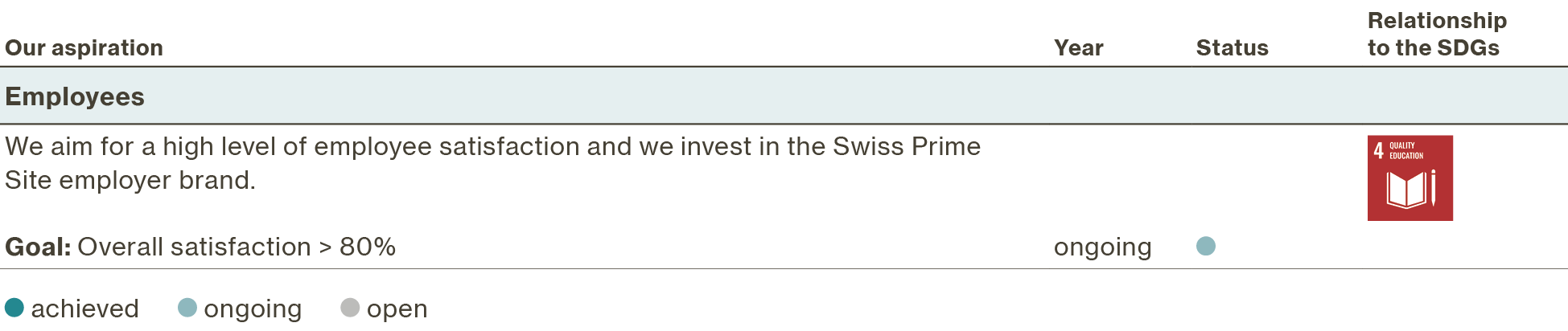

Employees

Our employees implement our sustainability strategy and are important external ambassadors. For that reason, it is essential that our employees understand our strategy and objectives and perceive us as an attractive employer.

Sustainability in use and operations

We are actively working on the sustainable orientation of our property portfolio. Our main tasks are clearly defined: we plan and manage income, invest in maintenance and renewal, and lower operating costs as well as vacancies. To do so, we cooperate closely with our tenants and service providers in Property and Facility Management. This ensures that we offer our customers the best services for the properties we manage. Our tenants are a very important stakeholder group for us, so it is crucial that we maintain open and constructive dialogue and cooperate closely with them. Their satisfaction, health and safety are our primary concern.

Climate neutrality 2040 and certification of stock

In the context of sustainable use and operation, Swiss Prime Site’s Real Estate business area focuses on a number of topics: the systematic implementation of certifications and recertifications under BREEAM1 In-use, more extensive cooperation with tenants in the area of sustainability through the introduction of green leases in rental contracts, and tenant surveys. In addition, we continue to consistently apply our property strategy in the context of the CO2 reduction pathway and the expansion of renewable energies, with the goal of being climate-neutral in our operations by 2040.

Tenants as partners in sustainability

We can only successfully implement sustainability topics in collaboration with our tenants. Goals and initiative are developed together with them and established as binding.

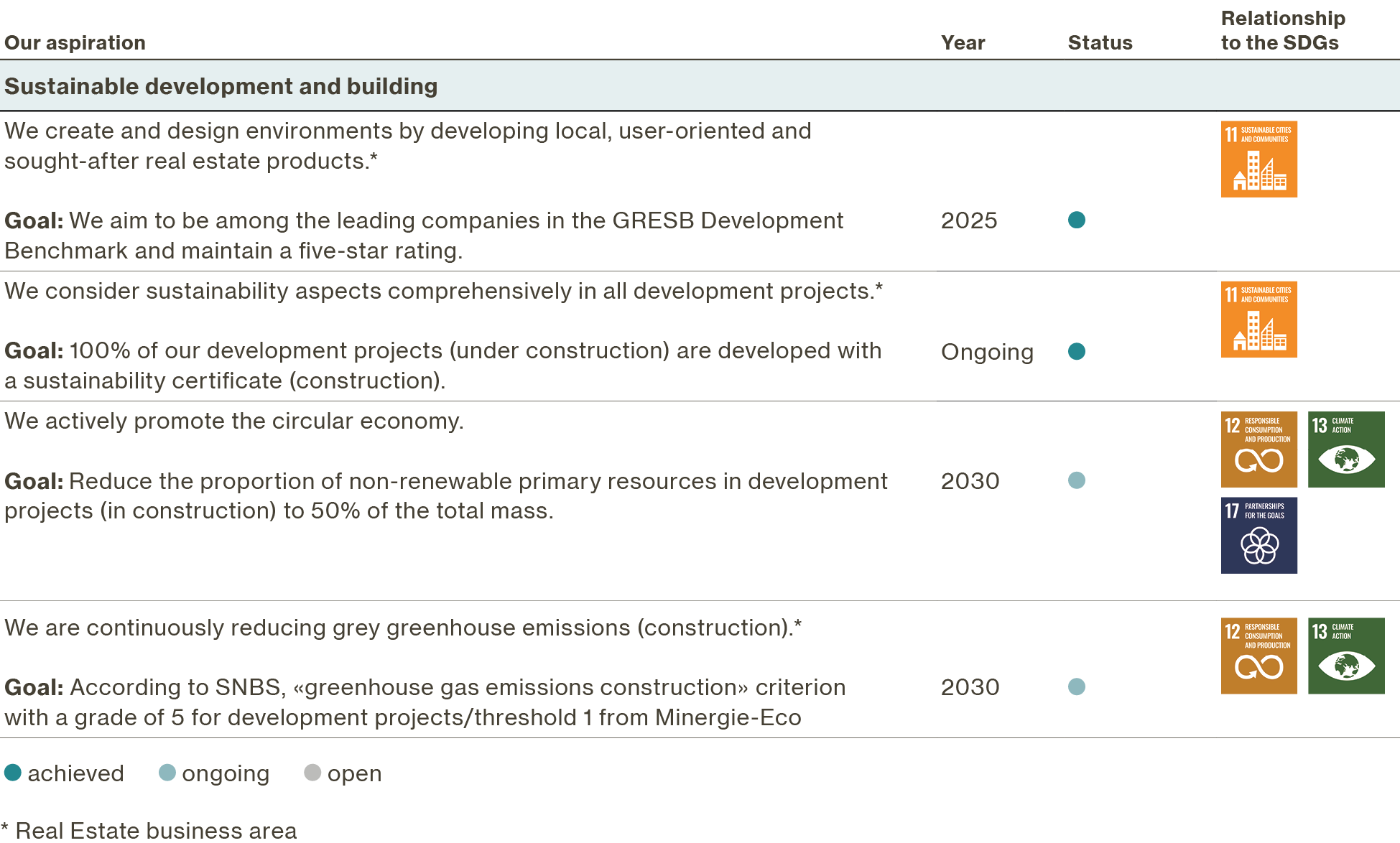

Sustainable development and construction

Our corporate strategy is shaped by the established development business in the Real Estate business area. For us, this means the development, ordering, planning and implementation of large, complex new construction and re-development projects.

Certification strategy as a quality control tool

The certification strategy is a key element for Swiss Prime Site Immobilien. Certifications play an important role in our sector. In the development area, processes are aligned with the Swiss Sustainable Building Standard (SNBS). The specific building label that properties obtain after completion depends on the individual case and user requirements. The certification process and review by an independent certification body ensure that our investments satisfy very high standards and are consistent with the Green Finance Framework. This means they qualify for external financing.

Circular economy

Circular development means devising innovative concepts as early as the strategic phase to extend the life cycle of components wherever possible. As a co-initiator and first signatory to the «Circular Building Charta», we are committed to pursuing its ambitions in our projects, to developing them via project-specific measures, and to making those goals measurable. We work closely with the Charta community.