Story Detail

Resources in mind – sustainable investing in circular buildings

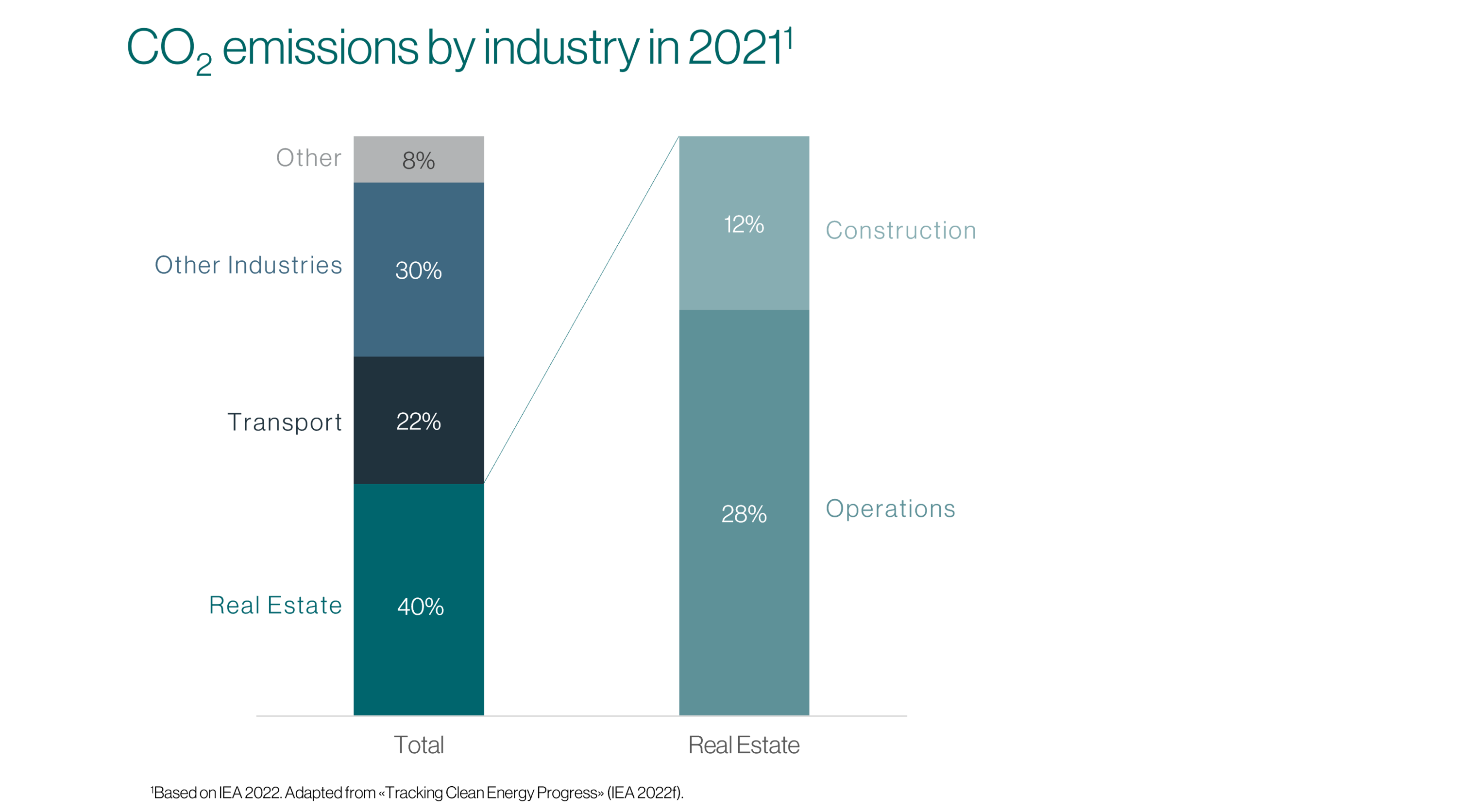

Buildings account for approximately 40 percent of global CO2 emissions each year, making them the largest emitter alongside the transport sector and other industries. They have a substantial impact on the environment both during their construction and their subsequent operation. It is therefore essential that the environmental strategy of a real estate company always covers the entire life cycle of a building, so that the effectiveness of eco-friendly solutions can be proven.

Real estate is also a highly capital-intensive business. Investments require a lot of capital, whether for buying properties or building them. Swiss Prime Site is currently investing around one billion Swiss francs in first-class new build and refurbishment projects over a five-year period. It is important that these investments are selected and structured in a way that not only generates financial returns but also contributes as much as possible towards achieving climate targets and creating benefits for society.

Circular construction

Throughout the entire life cycle, an estimated 90 percent of avoidable greenhouse gas emissions can be prevented in the development and execution phases, but only around 10 percent in the operational phase. This means that those who don’t consider the environment until a building is in use are too late, as decisions made during the planning phase have long-term implications. As a result, the circular economy is rapidly growing in importance in the real estate sector, not least due to the high consumption of resources and the large volumes of waste. In alignment with the signed «Circular Building Charta», Swiss Prime Site is aiming to reduce the use of non-renewable primary raw materials to 50 percent of the total volume by 2030. Resource consumption and waste can be minimised by carefully planning the deconstruction of buildings, promoting long-term construction, reducing overall material usage and recycling existing materials. By consciously opting to use environmentally friendly materials such as wood, buildings can be turned into long-term, eco-friendly material depositories. One successful example of this concept is the refurbishment of the ageing office building on Müllerstrasse in Zurich city centre, which was completed in autumn 2023. The existing structure has been preserved and the aluminium cast façade reused. In particular, the demolition of the building shell was kept to a minimum, allowing more than 90 percent of the concrete (one of the most carbon-intensive materials in the real estate sector) to be reused. This alone made it possible to avoid 2 600 tonnes of CO2 emissions.

Low-emission operation

Swiss Prime Site’s property portfolio is geared towards sustainable utilisation. This should be as resource-efficient as possible in order to ensure low-emission operation of buildings over the long term. When it comes to carbon emissions, the goal is always clearly in sight: «net zero» by 2040. Numerous measures are having a big impact in this sense, such as: efficient energy and resource management aimed at reducing consumption and increasing the efficiency of buildings; building strategies aligned with the «CO2 reduction pathway» (e.g. heat pumps or district heating); procurement of renewable energy; generation and use of own renewable energy (e.g. photovoltaic systems). Swiss Prime Site had already made significant progress by 2022, cutting its CO2 emissions per square meter by 25 percent compared to 2019. This puts the company well ahead on its initial roadmap for becoming climate neutral by 2040.

Certifications for more transparency in sustainable investing

Swiss Prime Site wants to deliver on its promises to stakeholders and transparency plays a huge role in this. By the end of 2023, nearly all of the company’s buildings will have sustainability certifications from recognised institutes, which will also make the progress measurable. In the case of development projects, each one is already certified. At the same time, it is ensured – particularly through the «Swiss Sustainable Building Standard (SNBS)» – that the buildings are planned and constructed in accordance with the most stringent sustainability standards. For existing buildings in the portfolio, certification is based on the established «BREEAM In-Use» standard to confirm and continuously improve the sustainability and environmental compatibility of the buildings.

Given the high capital injection, borrowed capital is another key aspect for all real estate companies. Like on the investment side, Swiss Prime Site has developed the «Green Finance Framework» to use capital specifically for environmentally friendly projects and thereby connect sustainable investments with corresponding sources of finance. The clear strategy here is to use all significant new funding within the context of the sustainability strategy. This means that funds will be used for specific sustainable purposes related to the financing and promotion of (1) certified real estate, (2) energy efficiency and (3) renewable energy. Investors will therefore be able to have a direct, meaningful and long-term impact on the environment. Here, too, use of the funds will be externally validated to guarantee that the projects meet the highest sustainability standards and achieve the desired goals.

With its comprehensive approach to circular buildings, which considers resources during both construction and operation, Swiss Prime Site fulfils its social responsibility and, thanks to its size, can make a positive and meaningful contribution towards sustainability in Switzerland. At the same time, this strategy also offers investors the opportunity to focus on sustainable investments and make a direct and far-reaching contribution towards environmental protection.