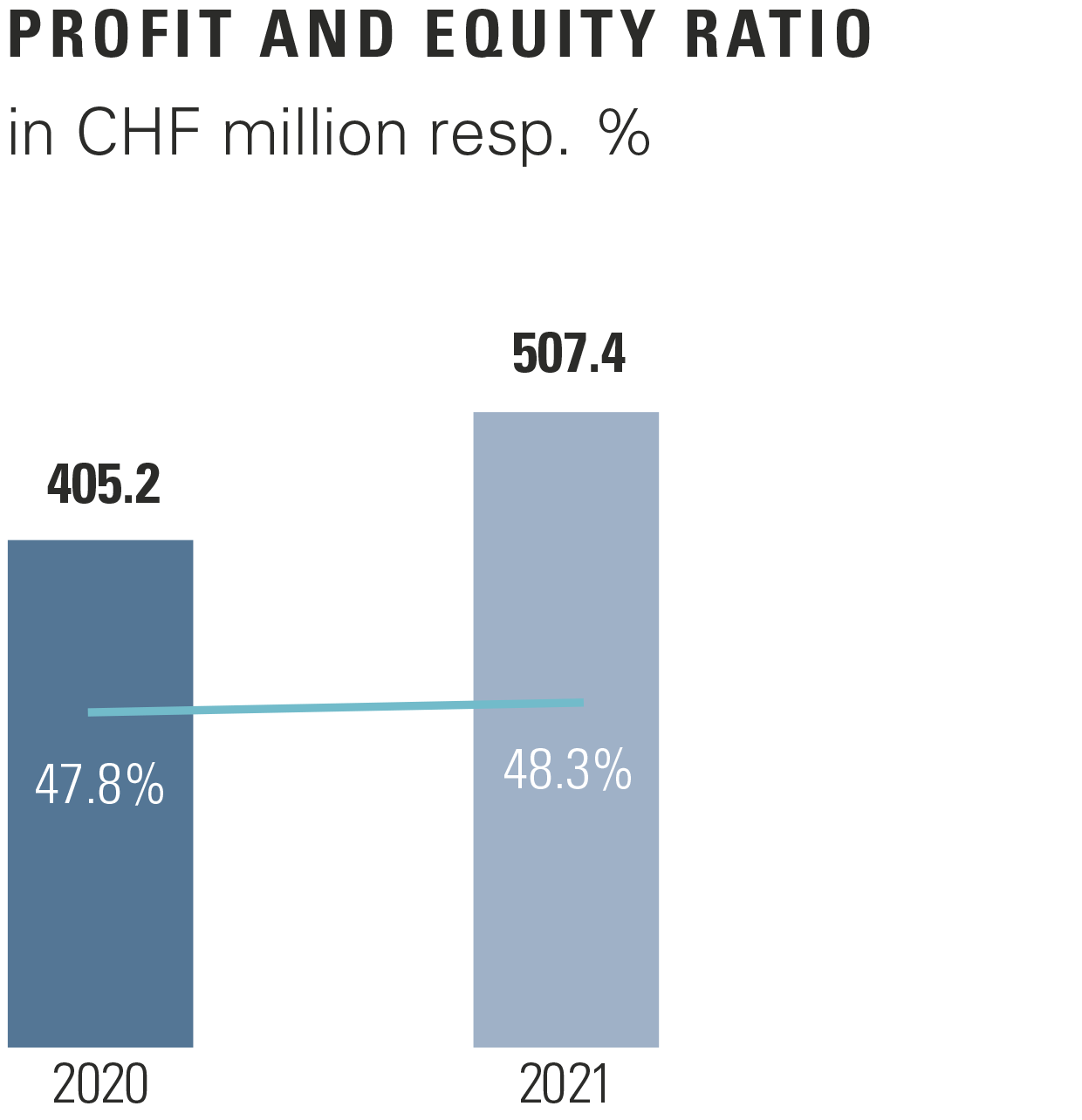

W e have all been living in extraordinary times for nearly two years now. Although we have gradually got used to the circumstances around us and learned to live with them, the pandemic has had a significant impact on all of us. Despite that, there were some encouraging signs from the economy and society in 2021. Over the last twelve months, the Swiss Prime Site Group has been successful in the market, achieving key strategic and operational milestones and reaching its objectives. With a profit of CHF 507.4 million, equivalent to CHF 6.68 per share, we have achieved very strong results. The Board of Directors will therefore propose a distribution of CHF 3.35 to the 2022 Annual General Meeting.

The 2021 financial year began with a lockdown that lasted several months. Over the course of the year, however, initial concerns about the potentially severe implications for the office space market were proven to be unfounded. The Board of Directors and management were therefore able to focus on core strategic and operational matters. These included further establishing the Swiss Prime Site Group as the leading real estate investment platform in Switzerland and realising an associated increase in the group’s profitability, resilience and sustainability.

This strategy also led us to acquire the successful Akara Group in Zug as at the end of 2021. This is complementary to our group company Swiss Prime Site Solutions. In the Real Estate segment, we achieved key milestones in four core areas: vacancy rate reduction, active portfolio management, optimisation of types of use and capital recycling. To further improve the Company’s flexibility and agility, we also significantly adjusted the Company’s financing in 2021 by arranging unsecured syndicated loans totalling CHF 2.6 billion. This new financing is also directly linked to our sustainability goals. Starting the construction of our first circular economy project on Müllerstrasse in Zurich represents a milestone in this area.

The renewal process within the Executive Management and Board of Directors continues apace. In 2021, we were able to fill key positions with Barbara Knoflach as a member of the Board of Directors of Swiss Prime Site, Martin Kaleja as CEO of Swiss Prime Site Immobilien, Anastasius Tschopp as CEO of Swiss Prime Site Solutions and Marcel Kucher as CFO of our Group. We are pleased that we can now propose to the Annual General Meeting that Barbara Frei-Spreiter will be replaced by Brigitte Walter on the Board of Directors of Swiss Prime Site. In addition to a generation change, we have also added more expertise to our committees. Remuneration guidelines have been further refined and linked to key sustainability ambitions.

My colleagues and I are pleased that we have been able to generate positive results even in these challenging times. This shows that our sustainable business model as a comprehensive real estate platform is both robust and agile. This redesigned review will give you an overview of the dynamics and key processes within the Swiss Prime Site Group.

I would like to thank all our employees for their considerable dedication during this challenging year as well as you, our shareholders, for your trust and interest in Swiss Prime Site.