Financial commentary

Swiss Prime Site performed strongly in the 2021 financial year and surpassed its own targets significantly. Both segments and all of the group companies contributed to this pleasing result. The fact that these results were achieved in spite of a lockdown lasting several months makes them all the more impressive. On a strategic and financial level, Swiss Prime Site has taken important steps to become even better equipped, more agile and more flexible in dealing with future challenges.

The sale of the Tertianum Group on 28 February 2020 limits the comparability of the 2021 key figures with the previous year. On the one hand, the 2020 figures include Tertianum’s results for two months. On the other, the profit from the sale (CHF 204.2 million) was allocated to the prior year period. In order to present Swiss Prime Site’s results and performance in a more transparent and comparable manner, we are publishing a supplementary «pro forma» calculation of the figures for the 2020 financial year, which excludes the aforementioned effects from the sale of Tertianum.

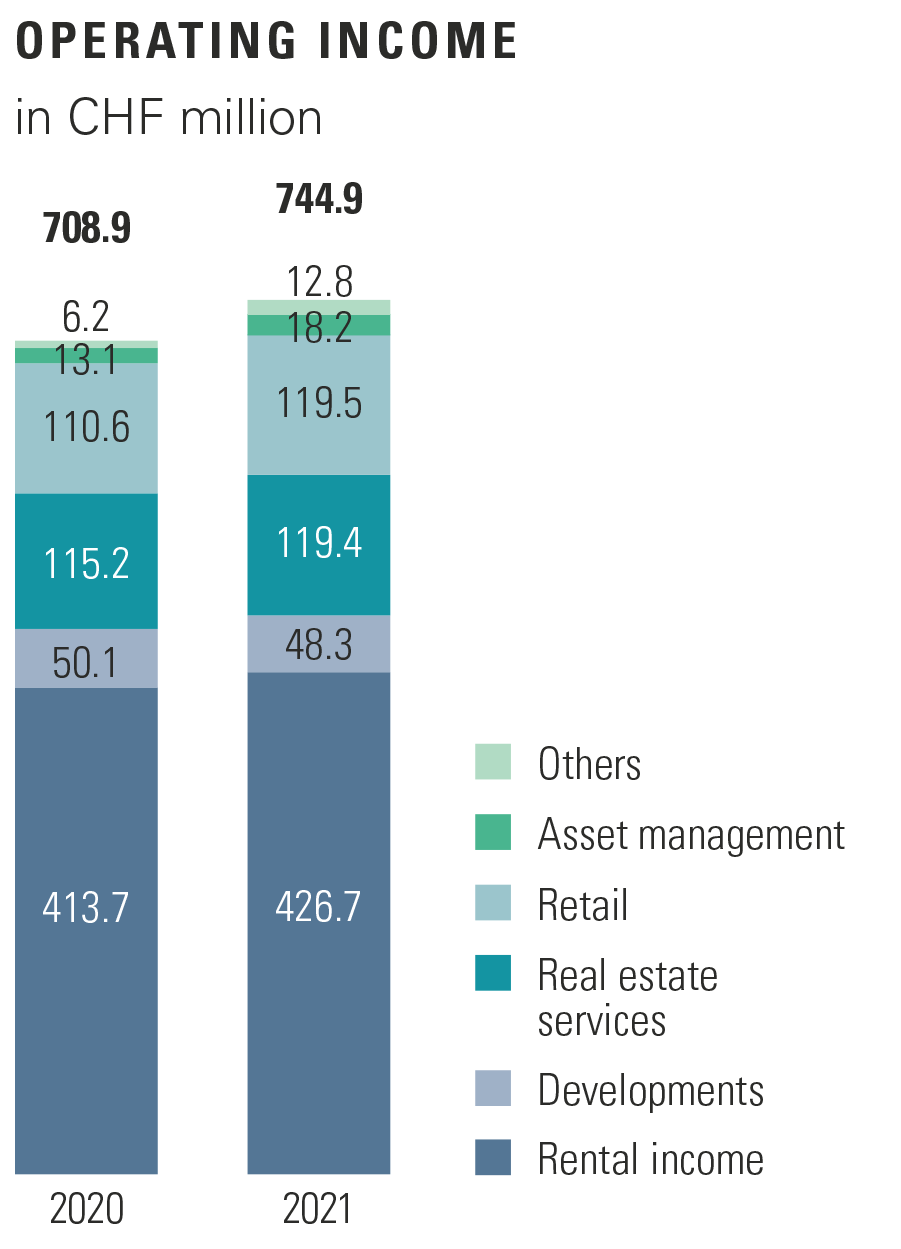

O n a comparable basis the operating income increased by a pleasing 5.1% to CHF 744.9 million. Both segments and all of the group companies contributed to this very good result. This once again highlights the stability and resilience of our Company, particularly in light of the pandemic situation, which continues to be challenging. The significant improvement in our results was mainly attributable to four key driving factors: the manageable impact of the COVID-19 pandemic, strong operating performance in the area of rental income from existing properties and development projects, the quality of our portfolio and the associated valuation outcome, and exceptional growth in the Services segment driven by the group companies Swiss Prime Site Solutions, Wincasa and Jelmoli.

1. COVID-19 pandemic

The ongoing pandemic affected Swiss Prime Site’s business in certain areas, particularly in the first six months of 2021. The Real Estate segment therefore reported a lower income by CHF 7.9 million (CHF 12.7 million). This is significantly less than the previous year’s figure and shows that our tenants are better at dealing with the pandemic. We are therefore expecting a lower impact in 2022. The amount is due firstly to rent waivers granted to tenants of CHF 4.8 million and secondly to a CHF 3.1 million drop in sales and parking income. All tenant requests received were completely processed. Agreements were reached with almost all tenants. 99% of all rents due were paid as at the end of the year.

2. Rental income: increase in operating income

Despite the rent waivers granted, rental income increased by an impressive 3.1% (target: +2.5%) to CHF 426.7 million. This result is due to the sharp decline in vacancies from 5.1% to 4.6% (target: 4.6–4.8%), projects that were completed and transferred to the portfolio, and growth in operating rental income (like-for-like: +0.5%). We were also very successful with letting existing properties and projects in the 2021 financial year. We let or re-let around 170 000 m2, exceeding the figure for 2019 by around one third. The rental market proved very attractive, with significant leases in the major centres of Geneva, Basel and Zurich.

3. Property portfolio: significant revaluation gains

The robust state of the market and the exceptional quality of our properties are also reflected in the value of Swiss Prime Site’s portfolio. Despite sales of CHF 146.4 million, the portfolio value grew by CHF 470.9 million to CHF 12.8 billion. Investments in projects of CHF 280 million and favourable revaluation gains of CHF 318.8 million both contributed to this positive development. Due to higher rents, however, the net yield on property remained unchanged at attractive 3.2%. This is a strong indication that we generated the valuation outcome with our operational activities.

4. Services segment: strong performance

In the Services segment, Swiss Prime Site Solutions again reported outstanding growth in real estate assets under management, reporting an increase from CHF 3.0 billion to CHF 3.6 billion. The group company’s operating income rose by 38.8% to CHF 18.2 million. Contributing factors were the launch of various products domestically and abroad, success in acquiring additional management contracts and the growth of existing products. The positive flow-on effects from this will begin to unfold fully in the coming financial year. Following its approval as a fund manager and acquisition of fund provider Akara, the real estate asset manager’s growth will be even more pronounced in 2022 and beyond. Wincasa asserted itself in a highly competitive market and reported improved operating income and 3.6% growth compared to the previous year. Despite an extended lockdown in the first half of the year, Jelmoli also improved significantly and reported an 8.1% increase in operating income. This represents a significant increase compared to the market as a whole.

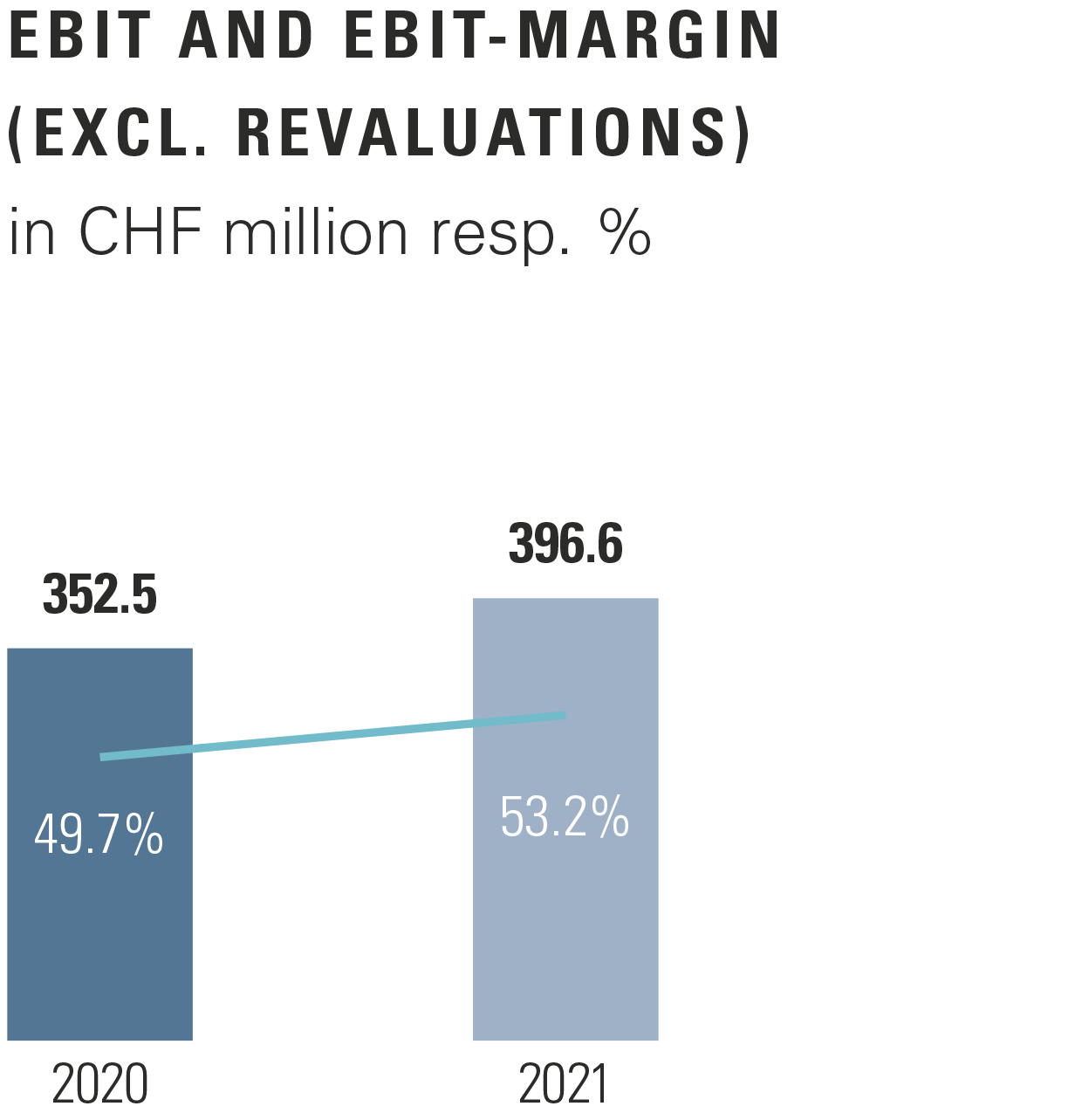

Exceptional increase in profitability

Thanks to stable personnel costs and only a slight increase in other operating costs, we were able to convert our increased income into significantly higher profitability. This positive development on the cost side clearly demonstrates the potential of Swiss Prime Site’s comprehensive property platform in terms of synergies, digitalisation and resulting improvements in efficiency. A total of CHF 54.8 million (incl. PoC) against CHF 36.1 million in the previous year in pre-tax profits was realised from sales. The group’s operating result (EBIT) before revaluations increased markedly by 12.5% (target: +5.0%) to CHF 396.6 million. Even excluding the effect of sales, an above-average increase of 8.0% was reported.

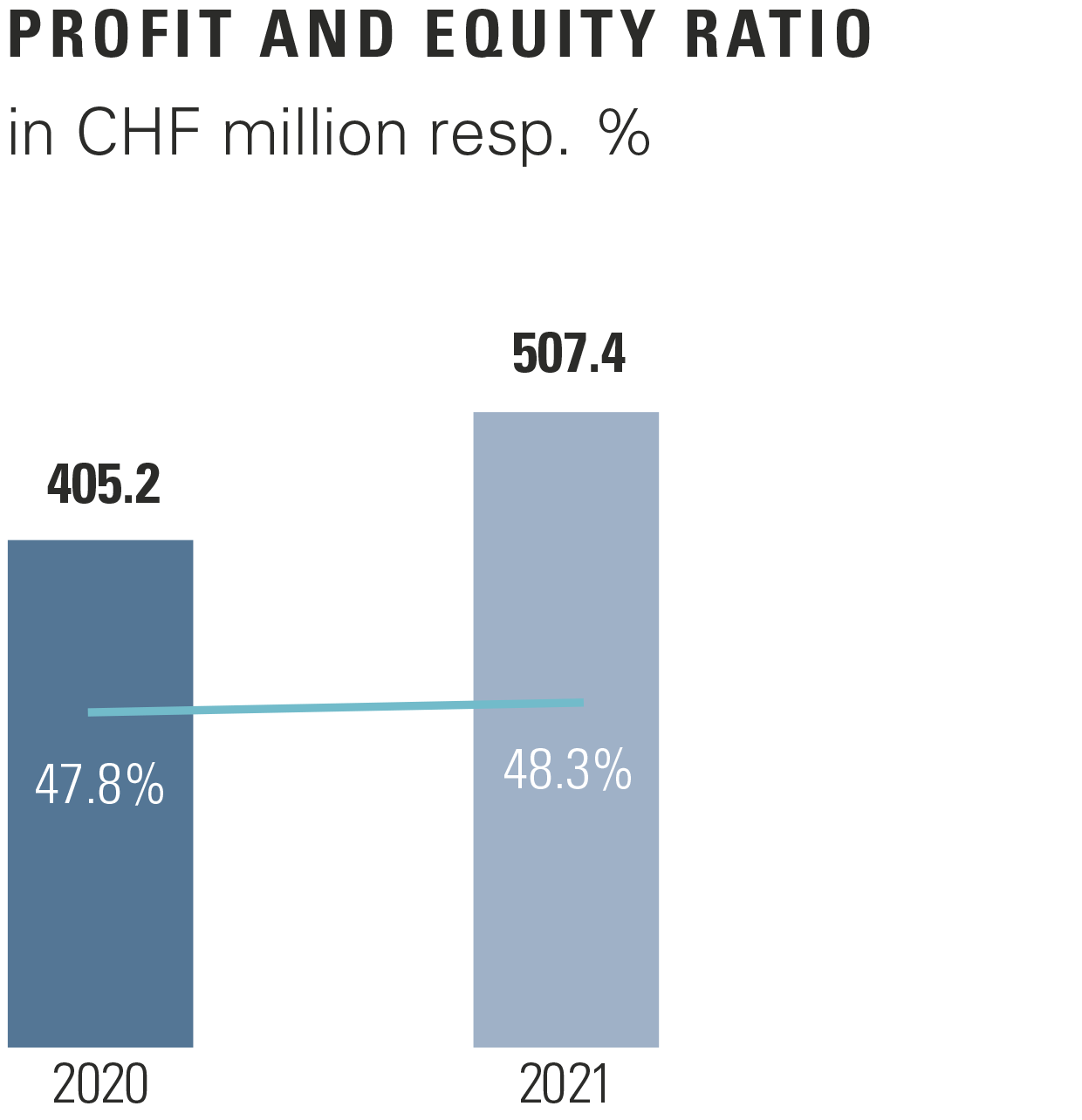

Impressive profit growth

In terms of company profit, Swiss Prime Site generated CHF 507.4 million, an increase of 25.2%. This result is all the more pleasing given that income taxes were higher and a special effect of CHF 24.9 million was recognised as a result of extensive refinancing at the end of 2021. The aforementioned one-off effect relates to early repayment charges and other costs associated with the discharge of bank mortgages amounting to CHF 1.8 billion. As a result of changing our sources of financing, future interest charges (associated with the discharged bank mortgages) will decrease by around 50%, or CHF 10–12 million per annum. The increase in income taxes is attributable to higher revaluation gains and gains from sales. Not including revaluation effects, Swiss Prime Site’s profit increased by 6.6% to CHF 289.5 million, or CHF 3.81 per share.

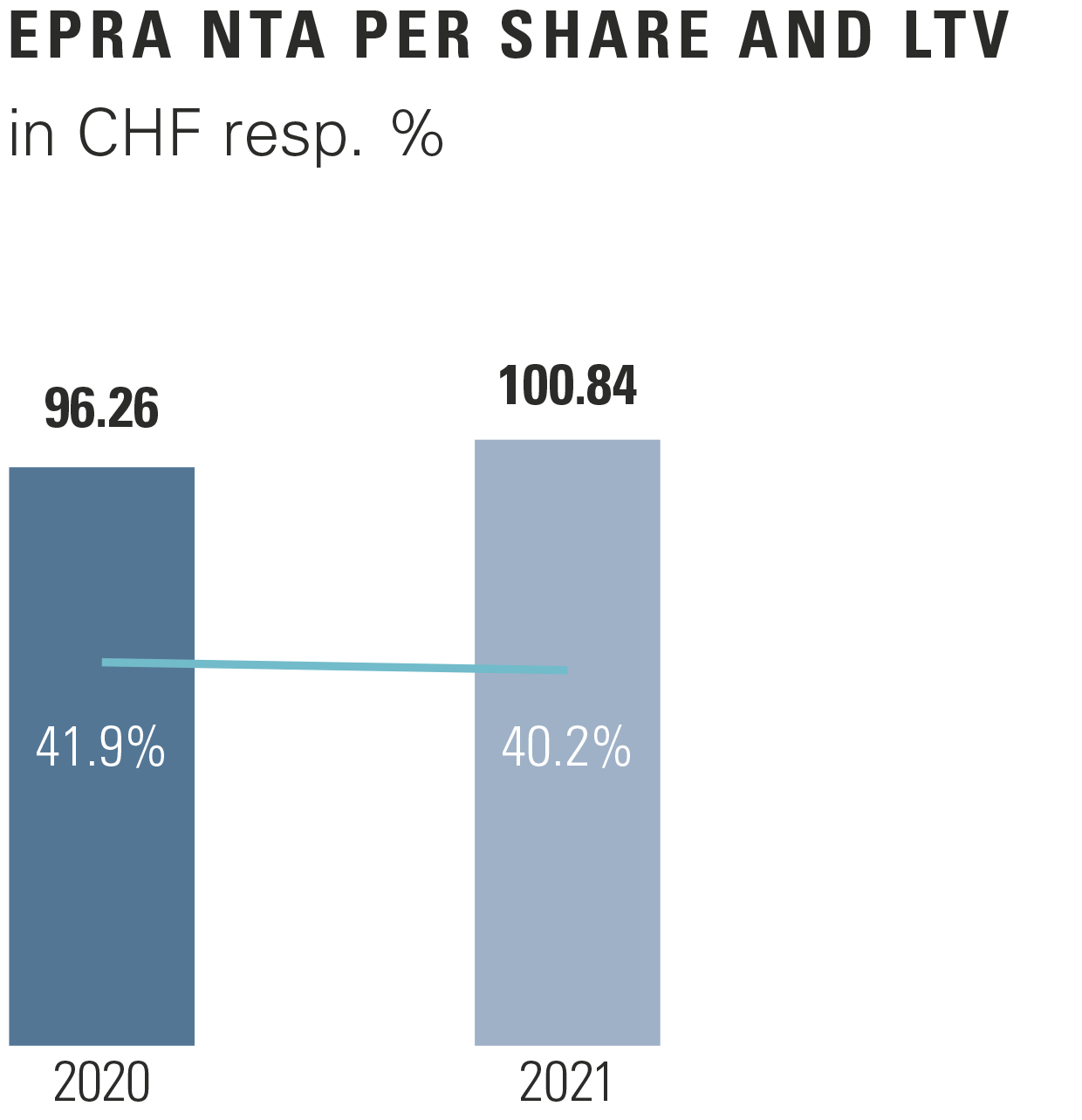

Strong balance sheet and FFO

Our strong results and the increased focus on further improving our balance sheet ratios (keyword: capital recycling) resulted in a marked 0.5 percentage point increase in the equity ratio, bringing it to a very solid 48.3%. At the same time, the loan-to-value ratio (LTV) fell by 1.7 percentage points to 40.2%. The newly defined target ratio of less than 40% is therefore already within reach. In net terms, that is after deducting cash holdings, the LTV amounts to 39.3%. As a result of the switch, the proportion of properties not secured by mortgages increases from 30% to 84%, and the average term to maturity from 4.8 to 5.8 years. Net asset value (EPRA NTA) increased to CHF 100.84 per share (+4.8%).

Funds from operations (FFO Cash) is a figure used in the European market as a key indicator of the operating performance of real estate companies. This figure is calculated without including the result of valuations or items not relevant to cash, such as depreciation, etc. As is already the practice in many international businesses, we plan to increasingly use this figure in future to measure our performance and, in the medium term, use it as the basis for distributions. FFO I per share increased from CHF 3.59 to CHF 3.96 in 2021. In the new terminology, the steady dividend of CHF 3.35 recommended to the Annual General Meeting would produce an attractive payout ratio for

our shareholders of around 85%.

Positive outlook

Starting in the 2022 financial year, Swiss Prime Site will publish its annual figures in accordance with the IFRS international accounting standards, which will allow it to provide even more transparent and comprehensive information on the course of business. This change will make it easier to compare us with other companies in our sector and will provide all stakeholders with a more comprehensive and in-depth source of information. The aim behind this increasing transparency is to continually improve our appeal to diverse groups of investors. To ensure comparability and predictability, we will also publish indicative financial statements prepared in accordance with IFRS together with the 2021 annual figures (prepared in accordance with Swiss GAAP FER). There will be only marginal changes to the main key figures as a result of the change.

Our strong operating performance over the past financial year, combined with the strategic adjustments made to our financing strategy at

the end of 2021, the expansion of our business model to encompass a comprehensive platform for real estate investment, transparent accounting and the Moody’s A3/stable credit rating we recently obtained, all provide an optimal foundation for further increases in value in the interests of all of our shareholders.