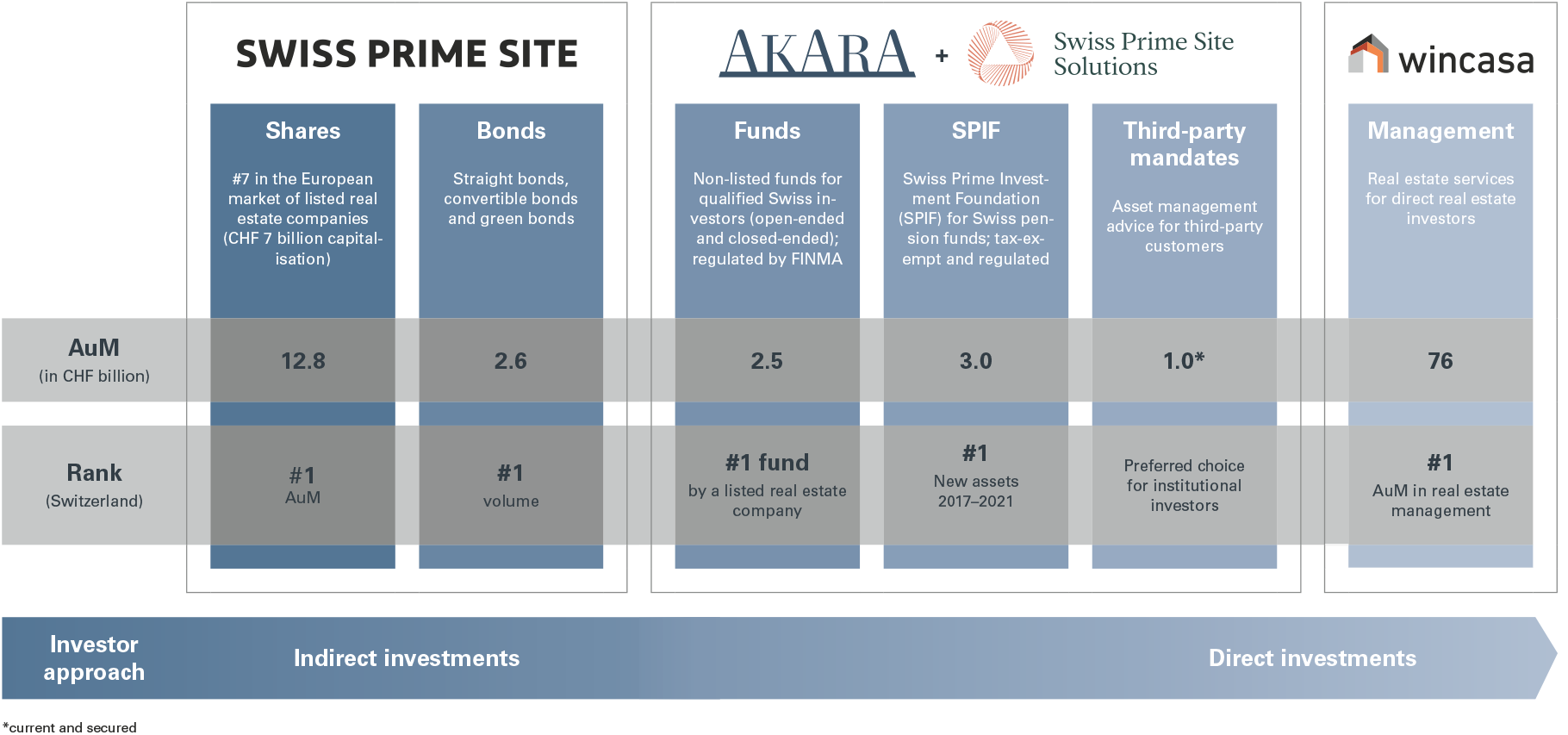

We are the leading partner for investors who wish to invest – or who already invest – both indirectly and directly in the real estate market. Swiss Prime Site thus covers the entire investor spectrum from private through to institutional investors. The product range includes funds (open-ended and closed-ended), mandates, investment foundations, straight bonds and the Swiss Prime Site share.

Investors can invest either directly or indirectly in real estate or in products based on it. We provide real estate investment vehicles and real estate mandates for the full spectrum of investors, from qualified private investors through to institutional investors. The investment strategies differ depending on the types of use, regions and financing requirements, as well as the legal regulations for the vehicles and mandates. The services offered for the investment vehicles and mandates cover the full value creation chain along the real estate life cycle. This includes successfully acquiring a property or site, project development and project realisation, portfolio and asset management, property management and divesting properties, sites or parts thereof as well as capital procurement. The investment platform is a knowledge platform that enables high levels of customer benefit across important topics such as ESG/sustainability (e. g. circular economy) and real estate development. Synergies can be leveraged here that create additional value for our customers and therefore also for our investors. Swiss Prime Site works to the highest quality and sustainability standards and systematically focuses on current and future market needs. The goal is to ensure long-term value generation along the fields of activity of stakeholders, finance, infrastructure, innovation, ecology and employees.

We manage real estate investment vehicles and real estate mandates for the full range of investors, from experienced private investors through to institutional investors.

With more than CHF 19 billion in real estate assets under management, Swiss Prime Site is one of the leading real estate companies in Europe. The Swiss Prime Site Group comprises the group companies Swiss Prime Site Immobilien (property portfolio), Swiss Prime Site Solutions (funds and real estate asset management for third-party customers), Wincasa (real estate management for Swiss Prime Site Immobilien, Swiss Prime Site Solutions and third-party customers) and Jelmoli (omnichannel premium department store).