Ratings and benchmarks

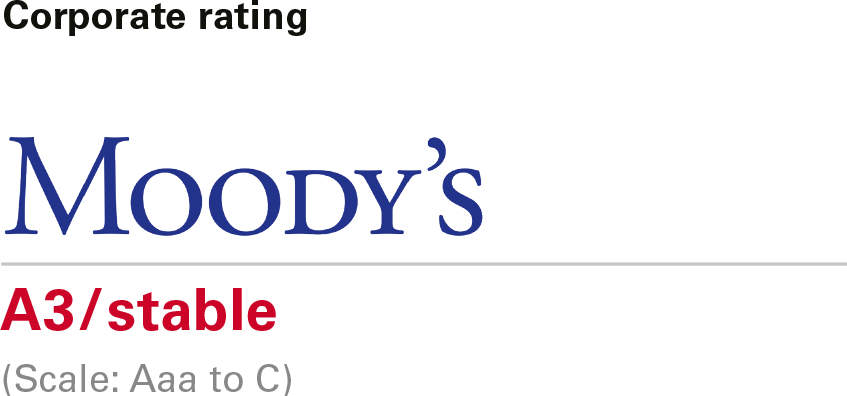

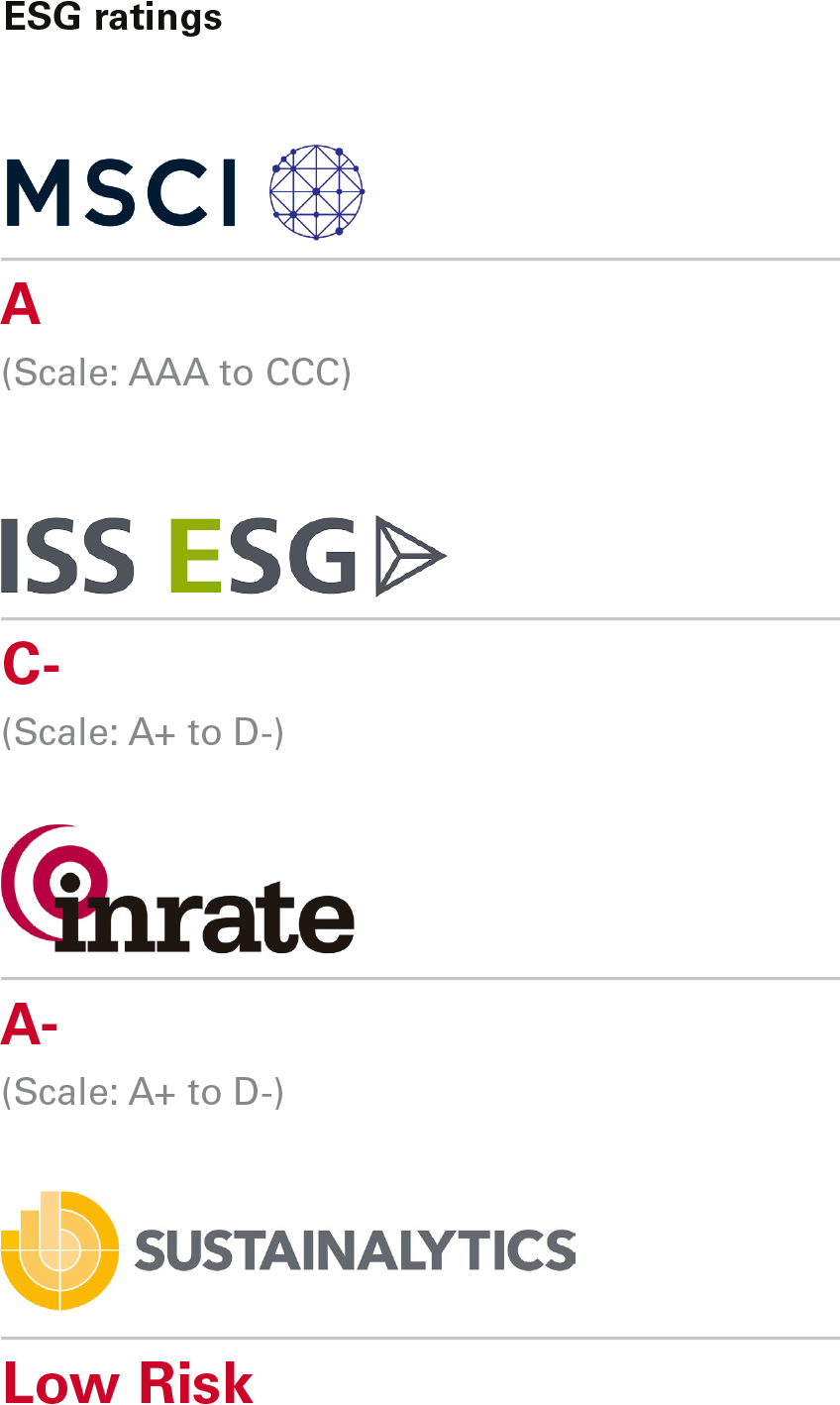

Swiss Prime Site is evaluated by the following leading ratings providers. The rating agency Moody’s assigns an A3 long-term issuer rating to Swiss Prime Site with a stable outlook. The rating received confirms the strong creditworthiness and strategic orientation of the Swiss Prime Site Group. GRESB evaluates the sustainability of global real estate investments. In the 2021 assessment, the property portfolio of Swiss Prime Site Immobilien received the «Green Star» award. The 2021 ratings issued for Swiss Prime Site by the ESG ratings providers Inrate, ISS ESG, MSCI and Sustainalytics either remained the same or improved.

GRESB evaluates the sustainability of global real estate investments. In the 2021 assessment, the property portfolio of Swiss Prime Site Immobilien received the «Green Star» award. In addition, the GRESB scores are embedded as ESG targets in the Executive Board’s short-term incentive, thereby directly influencing the management’s annual remuneration.

The 2021 ratings issued for Swiss Prime Site by the ESG ratings providers Inrate, ISS ESG, MSCI and Sustainalytics either remained the same or improved. Since the end of 2021, the credit margins agreed in loan agreements with banks have been linked to the ISS ESG rating, meaning that the ESG performance directly affects the rate of interest to be paid. This enables Swiss Prime Site to further integrate financial and non-financial targets, building on the green bonds already issued.