Swiss Prime Site is assessed and evaluated by leading ratings providers in the areas of credit rating, ESG and corporate culture.

GRESB evaluates the sustainability of real estate investments globally. In the 2025 assessment, Swiss Prime Site Immobilien ranks among the international leaders in the categories «Standing Investment» and «Development», achieving excellent results. In addition, the GRESB scores are embedded in the Executive Board’s variable compensation as ESG targets, thereby directly influencing the management’s annual remuneration.

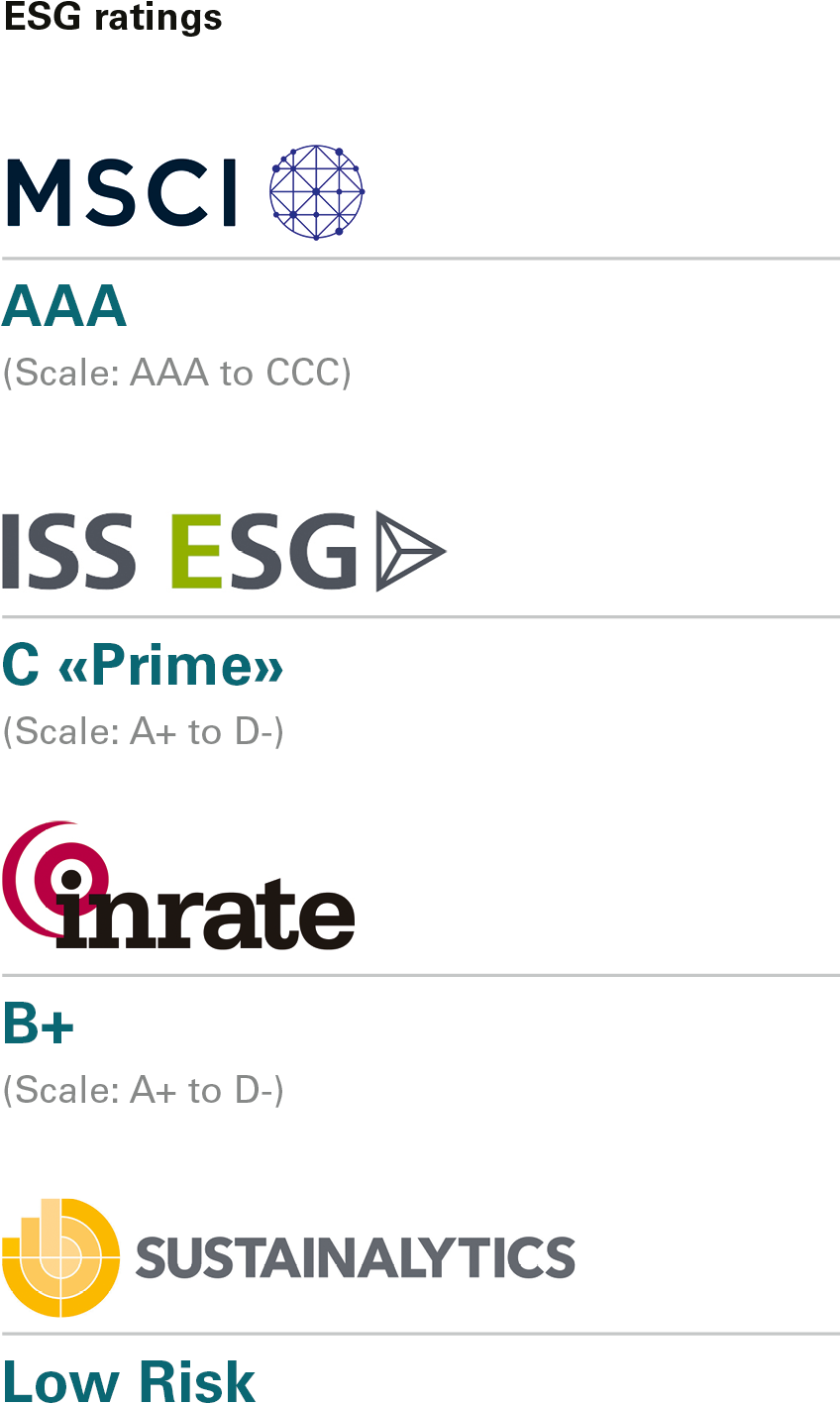

There was consistent improvement in the ratings issued for Swiss Prime Site by the ESG ratings providers Inrate, ISS ESG, MSCI and Sustainalytics. Since the end of 2021, the credit margins agreed in loan agreements with banks have been linked to the ISS ESG rating, meaning that ESG performance directly affects the interest to be paid. This enables Swiss Prime Site to further integrate financial and non-financial targets, building on the green bonds already issued.