Real Estate segment

Swiss Prime Site Immobilien is a real estate investment company focusing on Swiss property. As at the end of 2020, the portfolio had a total value of CHF 12.3 billion. It consists of prime properties, mainly occupied by commercial tenants.

Business model

Swiss Prime Site Immobilien initiates the group’s value-generation process by acquiring commercial properties, sites or real estate. Swiss Prime Site Immobilien’s primary business focus is portfolio and asset management. Developing and realising real estate projects and converting and modernising entire sites are also very important ways of creating value. The prime property portfolio is strategically optimised on a continuous basis.

Property portfolio

Swiss Prime Site’s property portfolio contains high-quality property and locations. The portfolio as a whole also has a good sustainability balance sheet. To optimise this further, targeted measures are being taken and investments made as part of Swiss Prime Site’s CO2 reduction pathway. The aim is to continuously improve resource consumption and achieve climate neutrality in the property portfolio by 2040 (see CO2 reduction pathway).

As at the end of 2020, the portfolio comprised 185 properties in total. Total floor space increased to 1 673 005 m², while the vacancy rate was kept at 5.1% through proactive management despite the difficult environment.

Geographic allocation

According to Wüest Partner, roughly 80% of the group’s properties rank in the quadrants with the highest quality based on the overall market. The majority of properties (76%) are located in German-speaking Switzerland. In this context, the canton of Zurich and particularly Zurich City account for the main share in this region with 44%. Another important region is the Lake Geneva basin with a share of 22%.

Utilisation

Swiss Prime Site has mainly geared its portfolio to the needs of commercial and services businesses. Currently 44% is let as offices and 26% as retail units. The property portfolio’s maturity profile is long-term and thus attractive. Roughly 21% of net rental income is generated with rental agreements with a term of ten years or more. Another 34% of the portfolio is due for renewed leasing at terms of between four and nine years.

Highlights from the reporting year

In 2020, Swiss Prime Site Immobilien continued with the targeted growth of its portfolio. Major milestones were reached at Stücki Park in Basel, where the company is expanding floor area by more than 70 000 m² (laboratories and offices) by 2023. Tenants have moved into the first units. The multiplex cinema, which was completed in autumn 2020, did not open its doors until 2021 because of the pandemic. The «West-Log» project in Zurich-Altstetten and JED (existing building) in Schlieren are close to completion in early 2021. Elektro-Material moved into the «West-Log» logistics building as an anchor tenant. The two anchor tenants in JED, Halter and Zühlke, also moved into their rental space. As the buildings are flexible and can be used for a wide variety of office and commercial purposes, the new and future tenants will be able to structure the space perfectly for their activities. The Schönburg project in Berne and the YOND project in Zurich were awarded international architectural prizes in the reporting year.

As part of the further development of its portfolio, Swiss Prime Site Immobilien placed great emphasis in the reporting year on reducing heat and electricity consumption. To increase its own production of renewable electricity, it identified 18 properties in which additional photovoltaic systems could be installed. Of these, four facilities with a total installed capacity of around 380 kWp were put into operation in the reporting year. More projects will be completed in 2021. More information on reducing the ecological footprint can be found in the CO2 reduction pathway.

Project pipeline

One of Swiss Prime Site Immobilien’s strengths is its ability to develop its own projects. This means the company can operate with a high degree of autonomy from market cycles while at the same time improving the level of sustainability within the portfolio.

Development projects are based on the group’s strategic targets of boosting organic growth and increasing corporate profitability and renewing the portfolio through sustainable building materials and structures. Earnings from completed projects accrue in the form of revaluation gains, rising rental income and sales proceeds. New projects developed by Swiss Prime Site Immobilien generally exhibit above-average net yields compared to both the market and the existing portfolio and the highest sustainability standards.

The investment volume of Swiss Prime Site Immobilien’s project pipeline amounted to around CHF 2 billion as at the end of 2020.

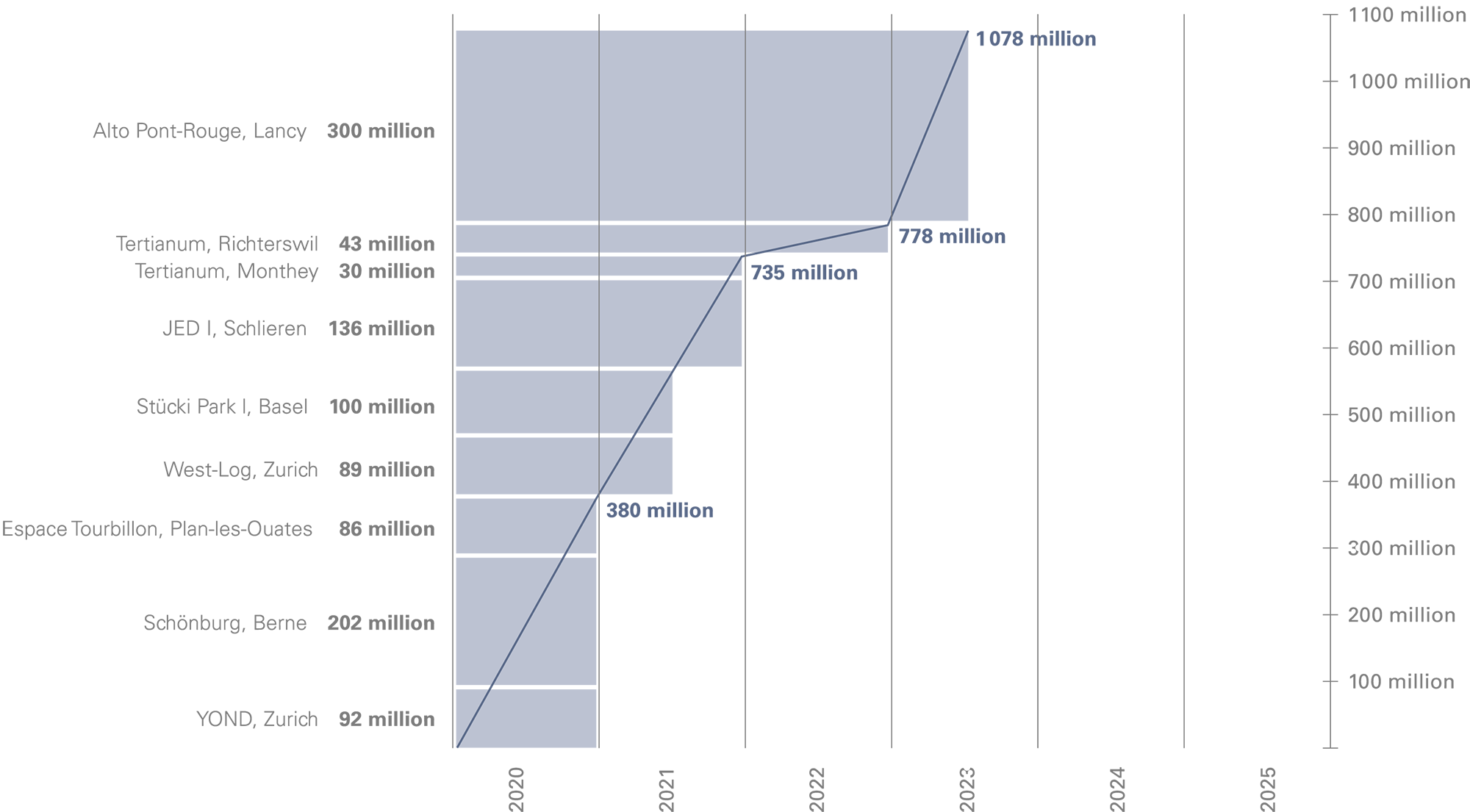

Projects under construction

The construction projects have an investment volume (including land) of around CHF 1 080 million. With a volume of CHF 300 million, the largest single project is Alto Pont-Rouge in Lancy. The project plays a significant role for the Geneva region due to its character and location, since another transportation juncture and economic hub will be created for the city as a result. Shortly after construction began in the second half of 2017, two of the five properties to be built at the large Espace Tourbillon development in Plan-les-Ouates were sold. Two other buildings are in the process of being sold, one of them in condominium owership. The fifth building (CHF 85 million investment) will be added to the existing portfolio. Projects under construction exhibit an average net yield that exceeds the current portfolio average.

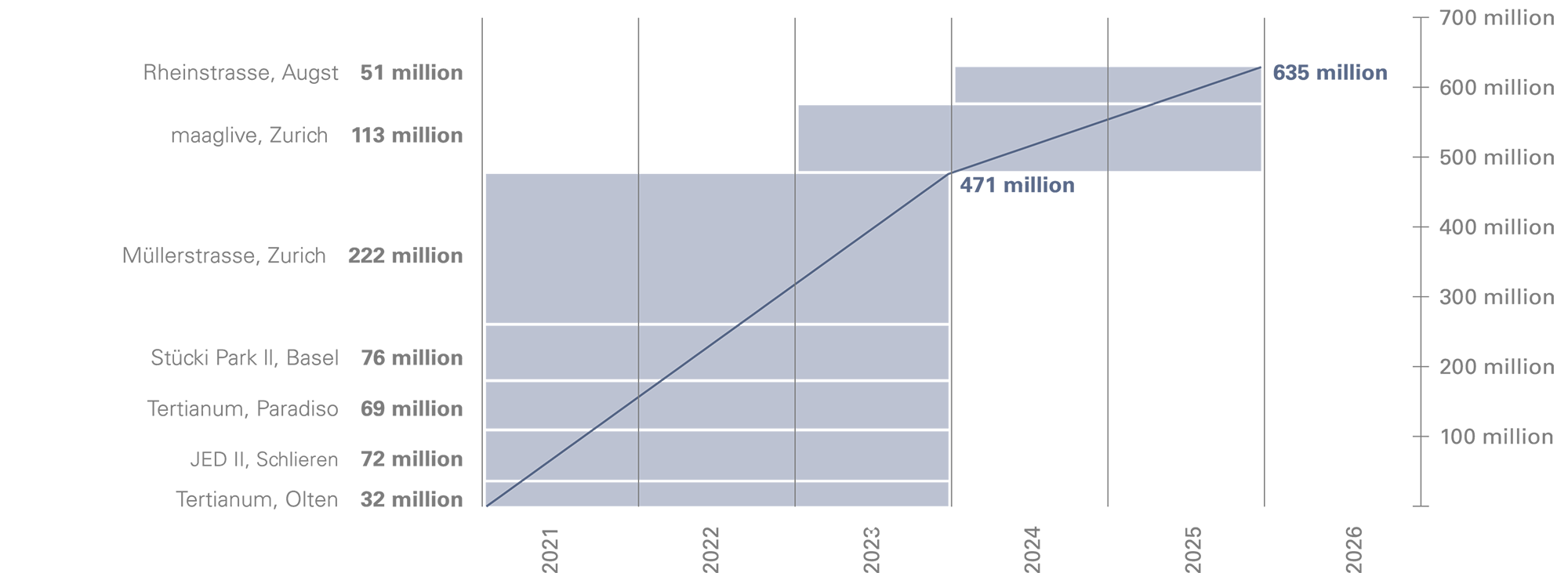

Projects in planning

At the end of 2020, projects in the planning phase had an estimated investment volume (including land) of around CHF 640 million. With a volume of CHF 222 million, the largest single project is Müllerstrasse in Zurich. This involves the large-scale modernisation of the existing office building. Four projects for the construction of new residential and geriatric care centres (Monthey, Olten and Richterswil) and a residence (Paradiso) for Tertianum are currently also in the planning stage or already under construction. In addition, Swiss Prime Site Immobilien has land reserves and considerable reserves of usable floor space in its stock.

Highlights from the reporting year

Swiss Prime Site also believes in the importance of having development projects that are sustainable. Since 2019, the company has been guided by the Swiss Sustainable Building Standards (SNBS) criteria and is also moving into new territory with regard to the topic of the circular economy. In what is a first, the Company is using circular concrete produced by the company Eberhard for the new JED building in Schlieren. This means it can massively reduce the primary resources of sand and grit and also store CO2 in the granulate of the secondary building material over a long period.