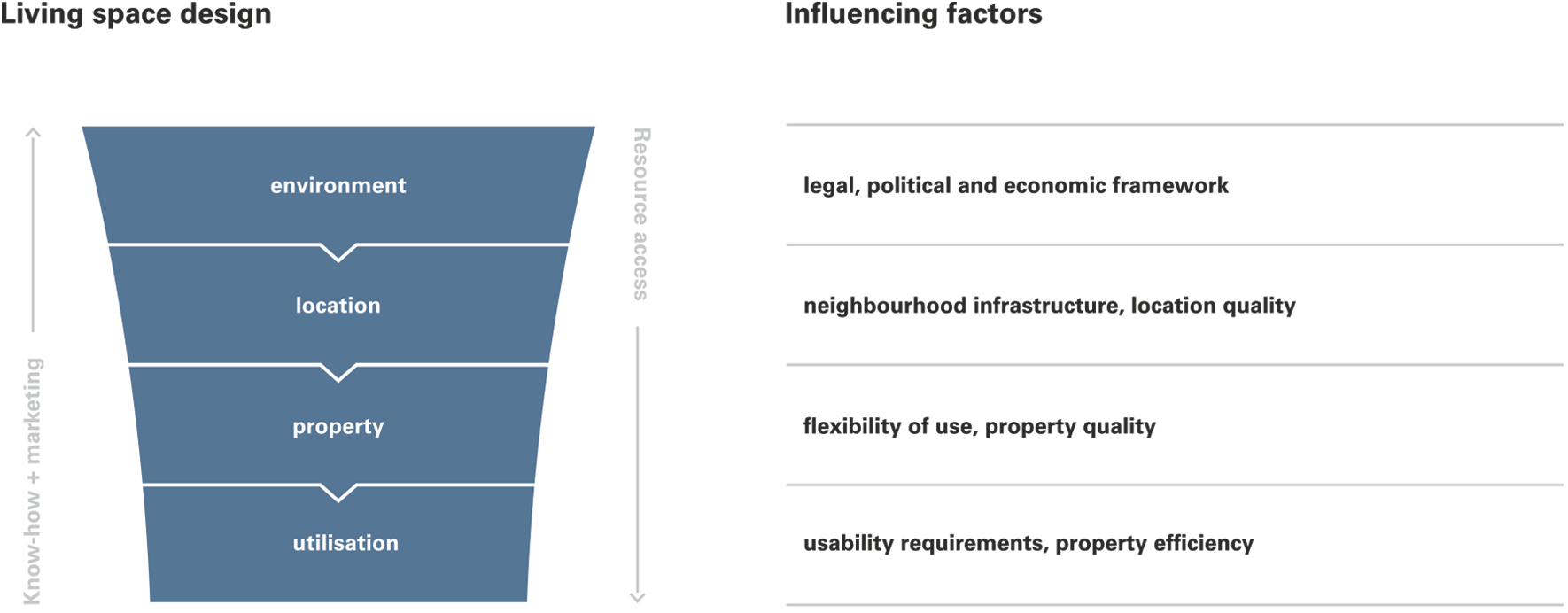

Business model and value creation

At the heart of Swiss Prime Site’s business model lies the evolution of «space within living space». Project development, construction and management, as well as company and third-party utilisation of properties, are key steps in this process. Swiss Prime Site develops and maintains sites and properties in accordance with the highest quality standards and in alignment with current and future market requirements. The aim is to ensure long-term value creation and continuous growth of the property portfolio. In pursuing this objective, the Company takes a holistic approach to corporate management, which, along with economic performance, also takes into account social and environmental aspects and is therefore geared towards safeguarding the Company’s long-term business success.

Alignment with customer and market requirements

The resilience of the business model is continuously assessed in light of social, political and regulatory developments and adjusted if necessary. Relevant trends, such as digitalisation, demographic changes or immigration can lead to expansions and adjustments of the value creation chain. Other influencing factors include market trends that necessitate the revitalisation of properties which are no longer suited to current needs, or changes to the interest rate environment. Alongside these macro and market trends, the needs of the main stakeholders also shape the environment in which Swiss Prime Site’s business model is embedded. The challenge is to address the concerns of customers, investors, the public sector, project partners and employees on a continuous basis.

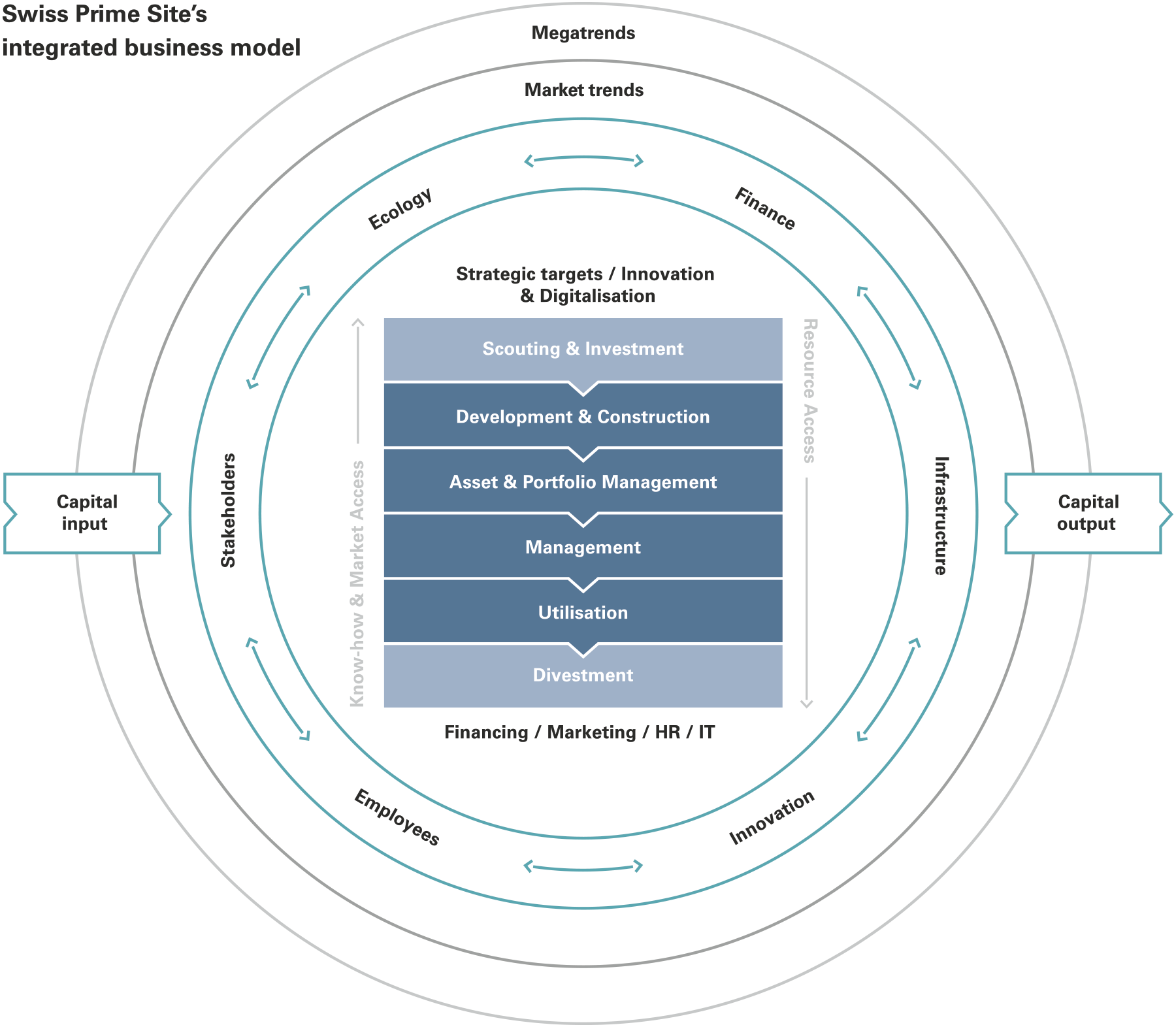

Vertically integrated group companies

The different value creation stages of the business model are vertically integrated across the five group companies Swiss Prime Site Immobilien, Wincasa, Tertianum, Jelmoli and Swiss Prime Site Solutions. The real estate portfolio comprising CHF 11.8 billion in properties is actively expanded and optimised by Swiss Prime Site Immobilien through acquisitions, developments, conversions, construction, financing and where necessary divestments. Wincasa plays an important role in the group structure by managing the properties of Swiss Prime Site Immobilien and third parties. The business model also allows use of part of the property portfolio: As a service provider in the assisted living sector and a premium department store respectively, Tertianum and Jelmoli use properties in the portfolio and therefore contribute also to the further strengthening of the business model. Swiss Prime Site Solutions has been offering comprehensive services for third parties as an asset manager since 2017. These range from acquisition, to development, conversion and construction, through to financing and divestment.

The portfolio of services provided to support the initial investment therefore covers every phase of the real estate life cycle, which broadens the earnings base while also spreading the risk.

Benefits for all group companies

The group structure of Swiss Prime Site enables its group companies to benefit from each other in a number of ways, be it by exchanging resources and expertise or from the fact that they can provide each other with access to different markets. In Swiss Prime Site Immobilien, Tertianum and Jelmoli can rely on having an owner with significant investment power, while they in turn represent reliable tenants and help the properties to retain their value. For Wincasa, Swiss Prime Site Immobilien is a key client who can develop innovative services. In return, Wincasa provides Swiss Prime Site Immobilien with important local insights into current market trends and client needs. Swiss Prime Site Solutions also benefits in myriad ways from the group structure. For example, the financial services were developed in close cooperation with Swiss Prime Site Immobilien. There is also a regular exchange of knowledge between asset managers in the two group companies. Together with Wincasa, Swiss Prime Site Solutions can offer additional «one-stop» services.

All group companies also benefit from overarching processes. Swiss Prime Site uses an innovation management system that spans the whole group. Future scouts working across the group identify trends that are relevant for the development of business in all group companies. Furthermore, marketing and branding as well as modern information technology architecture and contemporary employee development underpin the business model to further develop the concept of «space to living spaces».

Integrated value creation

Swiss Prime Site sees value creation as a comprehensive concept. Accordingly, business activities do not just focus on fulfilling financial objectives; they also look at non-financial aspects to ensure long-term value creation. The Company follows an integrated approach which focuses on innovation activity and added value for shareholders, customers, employees and suppliers as well as on responsible management of resources and the environment and positive relationships with other stakeholder groups.

Swiss Prime Site thus strives to continually optimise its value creation in accordance with the following six capitals of the International Integrated Reporting Council (IIRC):

Stakeholders

Relationship capital refers to the value of the network of all relationships with Swiss Prime Site customers and stakeholders. Sharing common objectives and values and creating trust is a strong basis on which to exchange valuable information. These relationships ultimately increase our reputation and add value to the company brand.

To strengthen stakeholder relationships, the Company maintains regular dialogue with all stakeholder groups and coordinates communications measures in a timely and appropriate manner. All group companies stay in close contact with customers in order to ensure they are satisfied and to react quickly to any new requirements. In 2019, another stakeholder panel took place, in which the topic of corporate responsibility was discussed with key internal and external stakeholder groups. Regular communication with investors and analysts was also a priority throughout the reporting year. This resulted in an increase of the number of registered shareholders to 11 266. In 2019, all agenda items at the Annual General Meeting were approved by the shareholders.

Finance

A stable and future-oriented company is based on financially sustainable management. Financial capital incorporates all the financial resources that Swiss Prime Site utilises to develop and render products and services. In addition to income from operating activities, financial capital includes funds released from targeted divestment and funds raised on the capital markets.

In 2019, Swiss Prime Site generated CHF 628 million in operating profit, 31% up on the previous year. Thanks to skilfully executed investments of around CHF 521 million and responsible management, 2019 was also a good year for shareholders. Earnings per share were CHF 8.00.

Infrastructure

One of Swiss Prime Site’s core tasks is to continue developing its products and services across the group and to ensure that they meet the needs of its customers and markets. Infrastructure encompasses real estate that is developed, used, rented or sold, as well as all the facilities that are used to provide our other real estate-related services.

The attractive spaces held in the portfolio were further enhanced in the reporting year by the completion of several construction projects including the YOND new build in Zurich Albisrieden and the redevelopment of Stücki Park in Basel. In addition, innovative products such as the Flex Office co-working spaces were developed. The portfolio currently comprises 187 properties. Total floor space increased to 1 604 451 m2, while proactive management reduced the vacancy rate to 4.7%.

Innovation

Intellectual capital is founded on the continuously developing expertise within the Swiss Prime Site Group and the intangible assets developed in collaboration with partners, such as patents, brands, software, rights and licences. Systems and processes that derive from these assets create specific competitive advantages in the market and actively help to capture future potential.

The positive performance achieved by Swiss Prime Site also reflects its forward-looking innovation strategy. Prior to the Accelerator Workshops conducted in 2019, approximately 250 start-ups were assessed for potential collaboration. The selection of topics considered by the Future Board also expanded further in the reporting year and led to six specific innovation projects.

Ecology

Natural capital refers to environmental resources from renewable and non-renewable sources needed now and in the future to render services. Managing soil, energy and water resources responsibly is a major priority for activities across our real estate business.

Swiss Prime Site acts to protect the environment and conserve resources, whether in its daily operations or in investments in real estate and its management. At the same time, the focus is clearly directed at the real estate portfolio, where invested capital realises the greatest impact. In 2019, Swiss Prime Site developed a CO2-reduction pathway for the property portfolio, based on ambitious energy consumption and emissions goals. The Company also analysed the portfolio with the aim of driving forward the increased use of solar energy. The CO2 intensity of the real estate portfolio (incl. services within properties of the Swiss Prime Site real estate portfolio) in 2019 totalled 22.27 kg CO2 per square metre.

Employees

The human capital of Swiss Prime Site encompasses all the knowledge, skills and experience of employees needed to bring the desired products and services to the market. The motivation and innovative spirit of the people who work for Swiss Prime Site are intrinsically linked to the implementation of our strategy and the successful sale of our products and services.

Swiss Prime Site’s success depends on how well it manages to retain and attract qualified employees, promote and expand their skills, empower them to assume more responsibility and motivate them. In a competitive market for talent, Swiss Prime Site's objective is always to have the best specialists at its disposal. In the reporting year, it invested around 1.4% of its wage bill in the training and development of its 6 506 employees. The medium-term goal of reducing the employee fluctuation rate to less than 15% is being maintained.